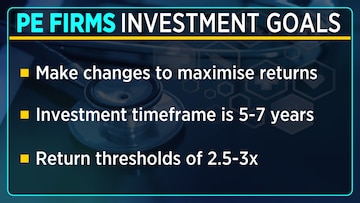

The owners or promoters of hospital companies usually opt for private equity (PE) investments instead of accumulating more debt. This injection of capital serves multiple purposes: to support substantial capital expenditures, enhance operational efficiencies, and capitalise on their ownership stake.

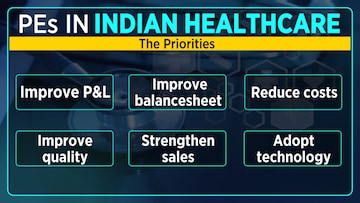

When a private equity firm assumes control, it prioritises actions such as bolstering the board of directors and the senior executive team (commonly referred to as the c-suite), as well as enforcing fiscal discipline. Private equity investors aim to enhance financial performance by curbing expenses, enhancing service quality, boosting sales, and embracing technological advancements, all of which collectively contribute to improving the company's profit and loss (P&L) statement and strengthening its balance sheet.

Over the last couple of years,

healthcare firms have garnered private equity (PE) investments amounting to Rs 27,000 crore. Notable deals reveal that private equity investors are drawn to the Indian healthcare sector for various reasons, including the comparatively lower number of hospital beds compared to other nations, heightened awareness and increased insurance coverage post-COVID-19, and India's emergence as a destination for medical tourism.

In an interview with

CNBC-TV18, Kaivaan Movdawalla, the India Healthcare Sector Leader and Partner at Ernst & Young, along with BS Ajai Kumar, who serves as the Executive Chairman of Healthcare Global Enterprises, delved into the increasing attraction of private equity investors to the

healthcare sector.

To begin with, Kumar explained that the private equity (CVC invested Rs 625 crore in 2020) investment in Healthcare Global (HCG) played a crucial role in the company's expansion and the establishment of stable operations. HCG has consistently had private equity investments, and the entry of these investors has also shifted the market's perception.

Kumar emphasised that they had maintained a presence of private equity investment even when they were a publicly listed company. Their growth had been in the range of 15-20 percent, primarily because their expansion strategy was strategic and simultaneous growth was occurring across multiple cities.

“After CVC came in, we were able to financially make sure that it was not coming in the way of our growth strategy in terms of putting in the necessary capex,

infrastructure, digital help, marketing, all of that was done well because of the funds which came,” Kumar said.

Regarding the challenges, Kumar highlighted the importance of careful selection when considering private equity as a promoter. He stressed the significance of choosing the appropriate private equity partner who comprehends the underlying concept. Success is marked when the right private equity entity collaborates with the right institution, fostering a partnership where both entities work together as a cohesive team, leading to achievements in patient care and financial performance.

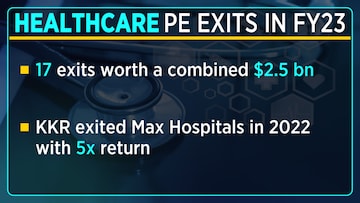

Meanwhile, Movdawalla mentioned that during this year, there have been 50 merger and acquisition (M&A) deals within the healthcare sector. “The kind of returns that investors are seeing the kind of performance that the sector has really demonstrated a few more will surely be in the pipeline in the next few months, he said.

For the entire discussion, watch the accompanying video