The Indian hospital sector has experienced a substantial increase in investments, particularly from private equity firms.

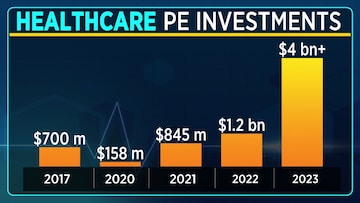

Over the past six years, investments have grown by nearly six times, reaching a total of $4 billion this year. This marks a significant milestone, with the sector witnessing billion-dollar investments for two consecutive years.

Investors are showing confidence in the healthcare sector due to factors like increased patient awareness, particularly post-COVID-19. They are targeting various segments, including multi-specialty hospitals, regional healthcare providers, and super-specialty hospitals.

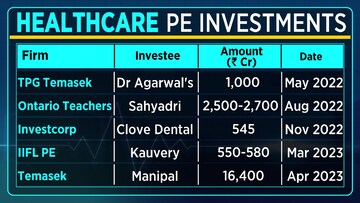

Examples of such deals include Ontario Teachers acquiring regional and multi-specialty play Sahyadri Hospitals, Temasek acquiring a majority stake in Manipal Hospitals, and IIFL PE investing in South-focused Kauvery Hospitals.

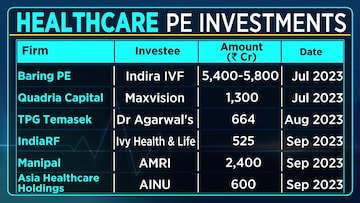

Additionally, there have been investments in single-specialty healthcare providers, including eye care, dental care, and infertility chains.

Recent investments include Piramal and Bain-backed IndiaRF's investment in Ivy Health, Manipal Hospitals acquiring a majority stake in AMRI, and TPG-backed Asia Healthcare Holdings AHH purchasing the Asian Institute of Nephrology and Urology.

India currently has a significant shortfall in healthcare infrastructure, with just over 0.5 hospital beds per 1,000 people as per WHO. This is considerably lower than China (4.3 beds per 1,000 people) and North America (2.8 beds per 1,000 people). The infrastructure gap investors say presents a compelling investment opportunity say experts.

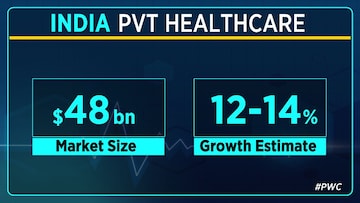

The private healthcare market in India is estimated to grow at an annual rate of 12-14 percent as per PWC, making it a lucrative sector for investors. The market is valued at around $48 billion.

Investors anticipate further growth driven by factors such as increasing health insurance penetration (currently at 0.4 percent), a greater emphasis on preventive healthcare, and expansion into smaller cities and towns.

Read Here | New Listing: Jupiter Life Line Hospitals lists at a 32% premium to issue price, becomes 23rd listing of 2023

However, valuations in the healthcare sector have expanded significantly. The EV/EBITDA multiples have increased from 10-15x before the COVID-19 pandemic to 15-20x at present.

Well-located multi or single-specialty healthcare providers can command even higher valuations, with some reaching 15-25x EV/EBITDA. For example, Indira IVF was at around 20x and Manipal over 25x. Valuations have also been aided by EBITDA growing 5-10 percent post-COVID-19, along with other factors such as the scarcity premium.

While healthcare is currently a top sector for private equity funds in India, experts suggest that the pipeline for fresh investments may be slowing down, indicating there could be potential challenges in finding suitable opportunities in the future.

Also Read | RML Hospital to open speciality OPD for transgender community on PM Modi's 73rd birthday

First Published: Sept 22, 2023 3:30 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

PM Modi visits Ram Mandir for first time since 'Pran Pratishtha', offers prayers before roadshow

May 5, 2024 8:59 PM

Visiting temples, obliging selfie requests, jabbing rivals – Kangana Ranaut is wooing voters on campaign trail

May 5, 2024 8:23 PM