Green shoots in the Indian economy, the COVID-19 situation somewhat coming under control, and rising inflation jitters had experts believe the Reserve Bank of India (RBI) would reverse its accommodative stance during the monetary policy meeting.

But, though some global central banks end liquidity measures taken to fight the pandemic, the RBI monetary policy committee (MPC) ended in status quo on key policy rates and an accommodative stance.

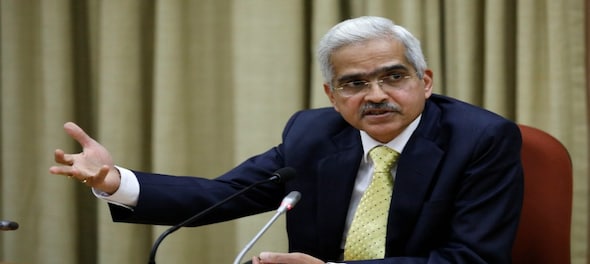

"Our monetary policy should remain attuned to the evolving domestic inflation and growth dynamics," RBI governor Shaktikanta Das said, according to MPC minutes. "Despite a recovery in FY22, real GDP was only marginally higher than the pre-pandemic level. Inflation pressures in India continue to emanate largely from supply-side factors."

Backing the RBI MPC's accommodative stance, Das said: "Economic recovery from pandemic remains incomplete and uneven and continued support remains crucial. So, it is wise to remain agile and respond in a gradual, calibrated and well-telegraphed manner to the emerging challenges."

While announcing the status quo on key policy rates, Das had referred to the lyrics of a song sung by the late Lata Mangeshkar -- "aaj phir jeene ki tamanna hai".

He said expected moderation in inflation trajectory over the next FY provides room for monetary policy to remain accommodative.

Showing some optimism, the RBI governor said the Omicron hit to pent-up demand tempered economic activity but with the return of normalcy, the pace of economic activity was likely to be bolstered by buoyant Rabi prospects, robust export demand, accommodative monetary and liquidity conditions, and improving credit offtake.

Still, he warned high commodity prices and supply-side shortages could weigh on corporate profitability. "We need to remain watchful of risks to domestic inflation from a rise in international commodity prices due to exogenous factors."

He had said while core inflation remains elevated, demand-pull pressures are still muted. "On balance, inflation is likely to peak in Q4 FY22 and, thereafter, soften to around 5 percent in H1 FY23," Das said.

RBI deputy governor Michael Patra also shared Das's observations.

"Global outlook is sombre. Inflation may take longer to slow – perhaps the greater part of 2022 – but slow it will," Patra said as per the MPC minutes.

"Pandemic inflation surge is not being driven by excess demand but by supply constraints. Monetary policy is an instrument of stabilisation. Its role is to align demand with supply, not the other way round," Patra said.

(Edited by : Amrita Das)

First Published: Feb 24, 2022 6:01 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

PM Modi visits Ram Mandir for first time since 'Pran Pratishtha', offers prayers before roadshow

May 5, 2024 8:59 PM

Visiting temples, obliging selfie requests, jabbing rivals – Kangana Ranaut is wooing voters on campaign trail

May 5, 2024 8:23 PM