After the Lok Sabha election results in 2019, CNBC-TV18 had predicted that the profitability of India's state-owned banks like State Bank of India, Bank of Baroda and Canara Bank, would improve strongly in the years to follow. The call turned out to be profoundly true.

Going into 2024, the question on many minds is, will the dream run in these stocks continue?

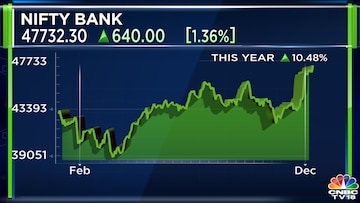

Data from Jan 1, 2019 to December 13, 2023.

On the face of it, a lot of the factors that fuelled the multi-year rally so far are in place still.

The Bharatiya Janata Party (BJP) has just won three big wins in state elections and the consensus on the street is that Prime Minister Narendra Modi would get re-elected in the Lok Sabha election scheduled to take place in the summer of 2024.

A day after the state election results on December 3, the stock market spiked over 1,500 points, reflecting the market's desire for political continuity in New Delhi.

Now, the fundamentals of PSU (public sector undertaking) banks are the strongest they have been in the last decade or two. The books are cleaner, corporates have shed the baggage of old loans and have a bigger appetite for borrowings, and the much-awaited boom in private investments is yet to take place.

From a zoomed out perspective, the odds are in favour of all banks, not just the state-owned ones.

"The largest overweight that we have currently is in financials because the valuations are extremely attractive there. Both private as well as PSU banks, we have a big overweight on PSU banks. Then we also like a couple of non-lending financials and of course, some of the lending NBFCs too," said Gautam Duggad of Motilal Oswal Financial Services, a Mumbai-based broking firm.

However, if one zooms in a little, another spectacular rally in PSU bank stocks is less certain now, than it was in 2019, because of a few changes in the context.

The biggest reason is the stocks aren't as cheap they used to be.

In 2019, the valuation of public sector undertaking (PSU) banks was measured by the price-to-book value (P/B), ranging from 0.4 times to 0.5 times, reflecting poor fundamentals at their worst. After the rally, the price-to-book ratio is much higher.

Currently, all PSU bank stocks are trading at least at par with their book value.

What does "price to book" mean?

Price-to-book value (P/B) is a way to measure a company's value. It's the ratio of how much the company's shares cost in the market (share price) compared to the value of its assets listed on the balance sheet, which is called the book value of equity.

Combine this with the underwhelming performance of private lenders, despite these being enviable franchises, like HDFC Bank and Kotak Mahindra Bank in recent months, PSU bank stocks may look a little less attractive than they used.

Madhusudan Kela from MK Ventures has realigned his bets a little. "I would go so far as saying that we have always liked public sector banks over private sector banks, but now on the bet is the mix of the public sector, and also some private sector banks, which have consolidated beautifully," Kela said.

Taher Badshah, the President and CIO at Invesco Mutual Fund, overseeing assets worth over $1 billion, concurs with Madhu Kela. Private banks will take the lead in the first half of 2024. Badshah now prefers public sector companies as a whole, from just public sector banks.

Going forward, it might be challenging to maintain the same pace of performance, especially with the anticipated decline in net interest margins (NIMs) when the Reserve Bank of India (RBI) starts cutting interest rates.

Interest rate on loans will get cheaper, faster than deposit rates.

Still some experts remain optimistic about the prospects for PSU banks.

“My sense is that the PSU banks over the long run will outperform the private banks because we have come out of a decadal bear market. I think SBI was disappointing and the second rung and third rungs were outperforming in PSU banks. Now, SBI also looks better poised,” Samuel, Senior VP-Quant & Alternate Strategy at Elara Capital, told CNBC-TV18.

Overall, the prospects in 2024 are looking good for all banks.

Heavyweight sectors like banks, which have been trailing behind for some time, have room for incremental money coming in and could lead the next leg of the market rally, according to Arvind Sanger, Managing Partner at Geosphere Capital Management.

Nitin Aggarwal, Senior Group Vice President and Head of BFSI at Motilal Oswal Financial Services, agrees with Sanger's perspective. His top bets are ICICI Bank, IndusInd Bank, SBI, and Axis Bank.

(Edited by : Sriram Iyer)

First Published: Dec 15, 2023 8:20 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

View | Congress manifesto vs BJP's wealth redistribution narrative — is it something out of nothing

May 2, 2024 9:10 AM

Two days left for filing nomination, Congress undecided on candidates for Amethi and Rae Bareli seats

May 2, 2024 7:32 AM

Lok Sabha polls: Polling time in Telangana increased by an hour, here's why

May 2, 2024 6:55 AM