In a prior article (see here), we had argued that India’s Flexible Inflation Targeting (FIT) framework places immense faith on an unproven ability of the policy repo rate to control CPI inflation, in our borrow-to-produce economy. It side-steps the impact of interest rates in areas such as the external sector, savings and investment. It focuses on the policy repo rate alone, ignoring other tools such as liquidity conditions, the term structure of interest rates, foreign currency intervention, and macroprudential regulations.

On the positive side, it offers simplicity and predictability that particularly appeal to foreign investors. In addition, it might also serve as a carrot-and-stick to nudge the government to control food prices and its fiscal balance, in exchange for lower interest rates.

In this sequel, we consider a more holistic monetary policy assessment in the current context, encompassing inflation, external balance, savings and financial stability.

Inflation

With a double-digit GDP contraction likely in FY21, India is seeing a severe demand shock. However, amidst rising government fiscal deficits and strong foreign currency inflows, money supply M3 is growing at a healthy 12.7 percent per annum, despite credit growth struggling at just 5.5 percent per annum.

Despite the slump in economic activity, CPI inflation and inflation expectations are elevated, likely on the back of supply bottlenecks. Nevertheless, when the pandemic subsides and the velocity of money limps back to pre-COVID-19 levels, the substantial overhang of M3 alongside the shift in terms of trade to the rural sector could pose inflation risks.

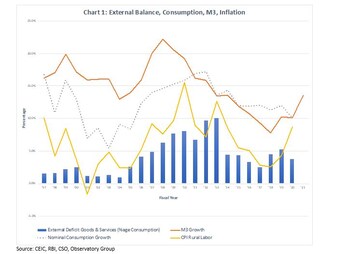

There is record excess capacity in the system currently. However, Chart 1 shows that a spike in M3 and consumption can lead to high net import of goods and services, and high inflation. We have historically struggled to match our consumption growth with domestic output and jobs.

Should M3 growth be curtailed now, by restricting one of credit growth, government deficits or foreign currency inflows? Credit growth is already at historical lows amidst fear and trust deficits. Suppressing this further with higher interest rates would make little sense. Government deficits, fuelled by tax shortfalls, are unlikely to react to monetary signals. Finally, as we shall see in the next section, opportunistic foreign currency inflows can paradoxically be curtailed by reducing short-term INR interest rates and increasing INR liquidity.

Eventually, if and when credit offtake and consumption pick up, domestic supply, inflation and net imports will bear watching closely. If the real sector ensures that supply, jobs and investment exceed the increase in consumption, a virtuous cycle can perpetuate. If instead supply falls short and inflation sets in, braking of M3 growth may become necessary.

External Balance

Interest rates, currency markets and capital flows are deeply interlinked, via what economists refer to as the ‘impossible trinity’. One manifestation of this is the ‘carry trade’.

Under ‘carry trades’, investors opportunistically switch from foreign currency assets to INR assets (or from INR loans to foreign currency loans), betting that interest gains would more than compensate for any INR depreciation. Examples of implicit carry trades include short term foreign portfolio investments into INR debt, repatriable INR deposits by NRIs, ECB borrowers leaving their currency risk unhedged, and exporters and offshore speculators selling forward foreign currency against INR. INR interest rates play a key role in determining the attractiveness of the carry trade.

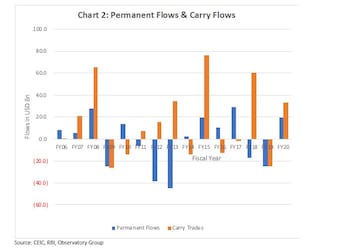

Chart 2 maps the estimated ‘carry’ flows over time, alongside the more ‘permanent’ external flows—which we define as the sum of current account balance, foreign direct investments and foreign portfolio investments in equity. The chart shows that carry-linked flows often overwhelm permanent flows. In fact, almost the entire net $200 billion currency intervention purchase by the RBI over the period can be attributed to net carry-influenced flows.

Over the past fifteen years, India’s net imports of goods and services have averaged 5.7 percent of consumption. As a self-correcting mechanism, besides real sector responses, INR should have adjusted down, helping shift the terms of trade towards domestic output and jobs. However, a wall of opportunistic carry inflows, influenced by India’s interest rates, has prevented a timely and adequate currency adjustment.

Let us now consider the current context. Permanent foreign currency flows could settle at a record USD 65 bn in FY21, with consumption and imports collapsing, even as FDI and FPI equity flows sustain. However, it is too early to call this trend durable. In fact, permanent surpluses will likely come down sharply over the next few years, as consumption limps back to normal. In the meantime, we remain a net importer of goods and services. As such, excessive INR appreciation now could impair India’s terms of trade and domestic industry.

Against this backdrop, India cannot afford to carry trade inflows now—both from the appreciation pressure on INR, and the growth in M3. In fact, now is the time to encourage a reversal of the carry trade. This in turn calls for very low short-end INR rates and high INR liquidity.

In addition, the current context strongly argues against RBI purchasing foreign currency in the forward markets. Such intervention keeps forward premia high, and can in turn encourage even more carry trades. In Q1 of FY21, RBI purchased $8 billion in the forward markets, with a view to avoid immediate INR liquidity injection. As a result, the implied INR rate in the USDINR 1-year forward premia is currently 0.8 percent higher than 1-year INR CD rates. It would have been far better to restrict currency intervention to the spot market, allow forward premia to fall, and hence encourage a reversal of the carry trade.

Savers, Borrowers and Financial Stability

While controlling M3, restricting INR appreciation, and providing interest relief to stressed borrowers call for low short-term interest rates and high rupee liquidity, that does short-change savers.

After all, with inflation expectations now firmly in double-digits, and considerable uncertainty around medium-term inflation, average bank deposit rates of 6.00 percent offer very negative real interest rates, particularly when adjusted for tax. It is no surprise that some savers are moving away from term deposits into equity markets and gold. This increases financial stability risks of an asset bubble or increasing wealth disparity.

One way to address this would be to reduce financial repression and ensure that the government pays the appropriate price at the longer end, commensurate with the large size of its fiscal borrowing. There is little long-term borrowing by the commercial sector towards investment at this point, and therefore the issue of crowding out should not immediately arise. Most existing banking commercial debt is anyway repriced within the year, and hence are more linked to short term rates rather than the longer end.

A steep curve—low short end rates and high longer end rates—should help optimise across the interests of commercial borrowers and savers while offering some control on currency markets and inflation. The cost for this curve would be borne by the entity borrowing the most, and with most control over the future of our economy—the government. Financial repression by way of excessive long-term OMO purchases and operation twists would hurt savers, and cause money to flow into speculative asset markets.

Putting It Together—An Alternative MPC Prescription

While inflation is elevated now, given already record low commercial credit growth, higher interest rates would not be appropriate at this stage to control money supply M3 growth.

On the contrary, short end rates need to be kept low (aided by high INR liquidity), so as to encourage a reduction in carry-trade foreign currency positions, reduce pressure on INR appreciation, and reduce M3 growth from foreign currency inflows.

The RBI should not purchase foreign currency in the forward market. That keeps forward premia elevated and incentivizes further opportunistic foreign currency carry-trade inflows.

To protect the interest of savers, and to restrict wholesale diversion of savings from fixed income to riskier asset classes, financial repression should be minimised, and the government should pay the fair price to fund its long-term borrowings.

In summary, a steep interest rate curve—low short-end rates and high long-end rates—might best optimise across managing inflation, our external balance, the interest of savers and borrowers, and financial stability.

As and when economic activity reverts to some normalcy, given the overhang of high M3, consumption and credit growth will bear watching closely. At that stage, if imports and inflation start to rise uncomfortably, rates may have to be nudged upwards to control credit and M3 growth. On the other hand, if the real sector responds with increased domestic output and jobs, a virtuous cycle of credit growth, consumption, supply, jobs, savings and investment can sustain for a long time.

—Ananth Narayan is Associate Professor-Finance at SPJIMR. The views expressed are personal.

Read his other columns here.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna Sexual Assault Case: Activist raises concerns over political interference, delayed investigation in the matter

Apr 30, 2024 10:17 PM

Lok Sabha Election 2024: Baramati election outcome will decide the future of Pawar dynasty, says expert

Apr 30, 2024 10:08 PM

Lok Sabha elections 2024: Baramati to Mainpuri, key battles in phase 3

Apr 30, 2024 7:01 PM