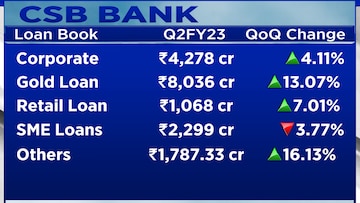

CSB Bank has seen a good comeback in gold loans. Its share of gold loans has risen to 46 percent in the second quarter of the current financial year (Q2FY23) versus 39 percent in the same period last year.

Speaking to CNBC-TV18, the bank’s MD and CEO Pralay Mondal, spoke about the outlook for the bank and the scope he sees in increasing his gold loan basket in 2023.

Mondal believes that gold loan is a large market for all lenders to address adding that CSB Bank has seen healthy growth in the gold loan finance business over the last 6-9 months and added that there are no risk bets and that non-performing assets (NPAs) are almost zero.

“Gold loan has been a strong growth area for us and in the last two quarters, we have done well. This is a good business to be in, we do not need risk bets on this and NPA is close to zero,” he said.

Talking about MSME and SME loans, Mondal said, “With the GDP looking reasonably okay and with the interest rate cycle hopefully picking up in another quarter or so, we should be able to see good growth in this segment.”

For more details, watch the accompanying video