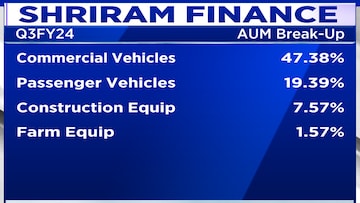

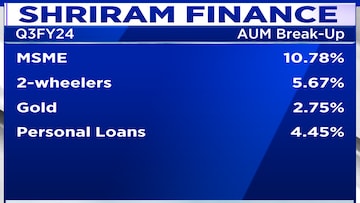

Shriram Finance, a top auto finance company in India, anticipates a 20% increase in its assets under management (AUM) this year.

It is confident that both the collections and asset quality will remain strong.

Umesh Revankar, Executive Vice Chairman said there could be a slight slowdown in growth spilling over into the first quarter of the financial year 2025 due to elections.

“People may not get into borrowing mode when election results come and there will be fewer sanctions, fewer approvals, fewer disbursals,” he said.

As of now, Revankar estimates slower asset base growth next year, at around 15% next year, as the first quarter may see some impact of elections. The company will also have a better sense of growth in the second half post monsoons, he noted.

Also Read

On March 13, Nomura upgraded Shriram Finance's rating to 'buy' and increased the target price per share from ₹2700 to ₹2900.

This non-banking financial company (NBFC) will replace UPL in the broader Nifty 50 from March 28, the National Stock Exchange (NSE) said in February, announcing a rejig of its key indices.

Shriram Finance has been included in the Nifty 50 index as it has the highest six-month average free-float market capitalisation within the eligible universe as a replacement for UPL.

The company currently has a market capitalisation of approximately ₹86,385.37 crore. Over the past year, its shares have surged by nearly 88%.

For the entire interview, watch the accompanying video

(Edited by : Shweta Mungre)