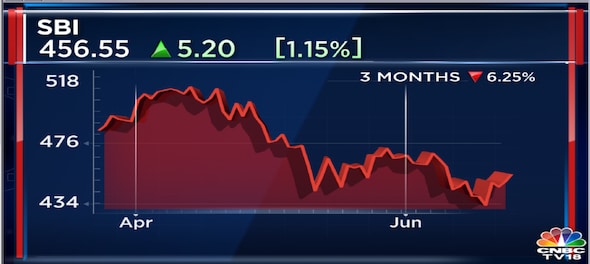

State Bank of India (SBI) shares rose on Friday, extending gains to a second straight day, global brokerage firm CLSA said the PSU lender's growth, margin as well as asset quality are heading in the right direction. The SBI stock moved higher by as much as Rs 8.8 or 1.9 percent to Rs 460.1 apiece on BSE.

CLSA maintained a 'buy' call on SBI with a target price of Rs 615 — implying a 36.3 percent upside from its closing price on Thursday.

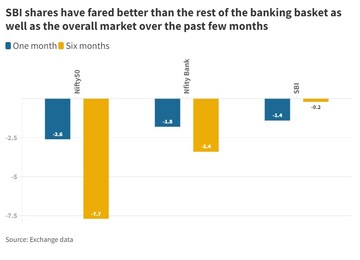

CLSA's view supports the trend seen on Dalal Street in the recent past, especially the recent market-wide sell-off.

CLSA is of the view that SBI's valuations are at undemanding levels. That comes at a time when the SBI stock has fared relatively better than its private as well as public peers.

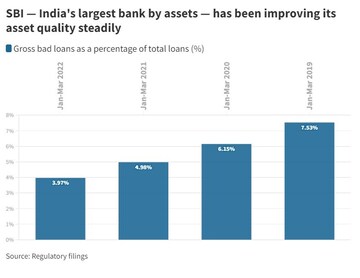

The PSU lending giant's credit growth is holding up better than expectations, according to CLSA.

The brokerage also sees a high certainty of improving margin for SBI.

| Brokerage | Rating | Target price | Upside vs Thursday's closing price (%) |

| Motilal Oswal | Buy | 600 | 32.9 |

| Geojit | Buy | 606 | 34.3 |

| HDFC Securities | Buy | 600 | 32.9 |

| LKP Securities | Buy | 565 | 25.2 |

SBI is well poised to sustain growth momentum with an improving digital penetration. The lender saw a sharp recovery in loan growth at around 12 percent in the six months to March 2022 following softness in the previous six months.

Motilal estimates SBI to sustain a CAGR (compound annual growth rate) of 12 percent in loan growth in three years till March 2024 driven by steady trends in retail and a recovery in corporate loans.

(Edited by : Sandeep Singh)

First Published: Jun 24, 2022 3:26 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh Lok Sabha elections: A look at YSRCP candidates

Apr 25, 2024 6:54 PM

Lok Sabha elections 2024: Banks and schools to remain closed in these cities for phase 2 voting

Apr 25, 2024 5:33 PM

Andhra Pradesh Lok Sabha elections: Seats, schedule, NDA candidates and more

Apr 25, 2024 5:16 PM