State Bank of India's results are expected to beat Street estimates from the second quarter onwards, said Ashwini Kumar Tewari, MD, International Banking, Technology and Subsidiaries, SBI, adding that the net interest margin will rise going forward.

The comments came three weeks after the lender reported its earnings for the first quarter, missing Street estimates. The bank reported a 6.70 percent year-on-year drop in net profit at Rs 6,068 crore as against Rs 6,504 crore in the same quarter last year. A CNBC-TV18 poll had estimated the net profit at Rs 7,688.2 crore.

Net interest income (NII) for the quarter surged 12.87 percent YoY to Rs 31,196 crore from Rs 27,638 crore in Q1 FY22, however, was lower than the estimates.

Net interest margin (NIM) — a key measure of profitability for financial institutions — for the June quarter came in at 3.23 percent, up 8 basis points from 3.15 percent YoY.

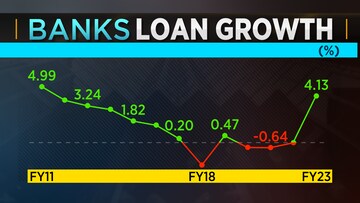

The lender witnessed a 14.9 percent loan growth in the June quarter, in line with the banking sector's credit growth in the range of 10-15 percent.

“Overall, compared to the last year, the growth is pretty good. So credit growth has come back,” said Tewari.

According to him, companies are coming back to banks from bond markets, leading to the credit growth.

"The pricing of the risk, which was a concern in the second half of FY22 when people were chasing good assets and quoting very low prices, has been corrected to some extent," he said.

SBI stock closed 0.62 percent higher at Rs 523.80 per share on BSE. It has gained nearly 2 percent in the last month and 27.51 percent in the last one year.

For the sector, as a whole, especially for public sector undertaking (PSU) banks, asset quality has improved in the June quarter. The net non-performing asset (NPA) ratio of PSU banks is now less than 2 percent for the first time in the last 30 quarters.

“Asset quality improvement has been a secular trend for the last several quarters starting from 2020 onwards. We have seen an absolute reduction in NPAs. So while slippages have been happening at a lower pace, but because of recoveries, because of upgrades etc., the overall reduction in the NPA has been absolute and in percentage both,” explained Tewari.

First Published: Aug 26, 2022 4:07 PM IST