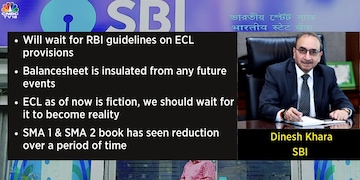

Expected credit loss (ECL) as of now is a fiction and we should wait for it to become reality, said Dinesh Khara, Chairman at State Bank of India (SBI) on Thursday. He further said that SBI will wait for Reserve Bank of India (RBI) guidelines on ECL provisions.

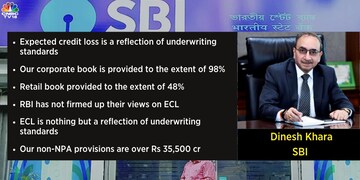

"ECL is a reflection of underwriting standards," Khara added while addressing media after the SBI posted its quarterly earnings.

Notably, the central bank issued a discussion paper on ECL in January 2023, seeking to move banks towards an expected loss approach with respect to bad loans. Lenders have recently sought one-year extension from the RBI for implementation of the ECL-based loan loss provisioning framework.

Under the ECL norms, banks will be required to classify financial assets into one of the three categories – Stage 1, Stage 2, and Stage 3, depending upon the assessed credit losses on them.

The central bank is yet to announce the final guidelines on ECL norms. However, some of the rating agencies have said that final norms on this may be notified by FY2024.

As of now, banks follow an incurred loss model where they make provisions only once repayments are delayed or not paid, but now, RBI has proposed that banks start providing as soon as they start expecting any kind of loss or non-repayment.

Meanwhile, SBI reported a rise of 83 percent in net profit at Rs 16,694.5 crore for the fourth quarter, as against CNBC-TV18 poll of Rs 15,053 crore. In the corresponding quarter of FY22, the lender had posted Rs 9,113.5 crore net profit. The net interest income (NII) rose by 30 percent to Rs 40,392.5 crore as against CNBC-TV18 poll of Rs 39,406.4 crore.

The lender reported improvement in asset quality for the quarter, with gross net performing asset (NPA) sliding 36 bps on quarter-on-quarter (QoQ) basis. The gross NPA was reported at Rs 90,927.8 crore, as against Rs 98,347 crore in third quarter of FY23. The net NPA came in at Rs 21,466.6 crore, as against Rs 23,484 crore in third quarter of FY23.

Commenting on the same, Khara that SBI has posted its highest ever quarterly profit for the third quarter running. Most of the bank's core profitability metrics have improved year on year and quarter on quarter. The core income stream have remained intact and credit growth has been robust across segments.

Now, he is expecting credit growth to continue in FY24.

"Although there may be some moderation in credit growth for industry," he said.

First Published: May 18, 2023 3:55 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna's father in custody for alleged kidnapping and sexual abuse

May 4, 2024 7:53 PM

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM