India's largest lender State Bank of India has reduced interest rates for its retail and bulk term deposits as well as time deposits with shorter tenors such as upto 179 days. The bank said it has cut interest rates on retail term deposits of less than Rs 2 crore by 20 basis points and on bulk term deposits by 35 bps.

"The Bank, in view of the falling interest rate scenario and surplus liquidity, realigns its interest rate on retail term deposits (less than Rs. 2 crore) and bulk term deposits (Rs. 2 crore & above) w.e.f. 01/08/2019," said the bank in a news release.

CFO Prashant Kumar told CNBC-TV18 that the deposit rate cut was triggered by a comfortable liquidity position. “It’s a 20 bps cut for more than 179 days maturity and a bigger cut for less maturity where our rates were higher,” Kumar said.

Talking about the lending rate cuts, he said, “Marginal cost of lending rate (MCLR) is formula-based pricing. So after this reduction in deposit rates from August 1st, when our Asset Liability Committee (ALCO) would meet then a decision would be taken on the impact on MCLR.”

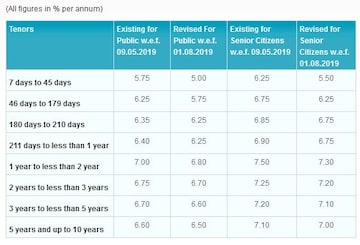

Interest rates on retail term deposit (Below Rs 2 crore)

According to the revised rates, less than Rs 2 crore term deposits with up to 179 days tenor will earn an interest of 5.75 percent now from 6.25 previously. Interest rates on deposits with 3 years to 5 years tenors were revised to 6.60 percent from 6.70 percent previously.

Interest rates on bulk term deposits for Rs 2 crore to Rs 10 crore

First Published: Jul 29, 2019 12:48 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh Lok Sabha elections: All about Congress candidates

May 8, 2024 2:11 PM

Finance Minister calls Sam Pitroda 'racist' — here's the full statement and reactions from BJP leaders

May 8, 2024 1:28 PM

PM Modi's 'Apni Kashi' set for massive 5km, 4-hour-long road show on May 13

May 8, 2024 11:25 AM