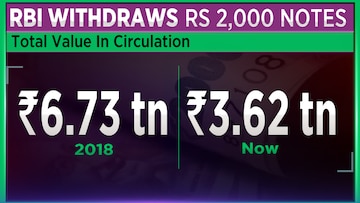

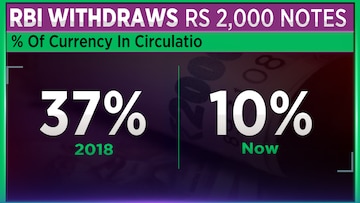

The Reserve Bank of India (RBI) jolted the country on Friday, May 19, with its decision to withdraw Rs 2,000 notes. In an interview with CNBC-TV18, Santanu Sengupta, India Economist at Goldman Sachs shared insights on the potential outcome of the Rs 2,000 notes circulating in the Indian economy.

According to him, a significant portion of these high-denomination notes will likely find their way back into the banking system, thereby augmenting bank liquidity. However, the exact amount of notes expected to be deposited remains unclear.

He also emphasised that the situation differs significantly from the demonetisation exercise India witnessed in the past. Furthermore, uncertainties loom regarding the fate of Rs 2,000 notes beyond September 30.

“There were some media reports over the weekend that the purchases of gold have gone up. Our sense is that ultimately, whichever route it takes, most of the Rs 2,000 currency notes will have to come back to the banking system and add to banking system liquidity," he said.

Talking further about demonetisation, Sengupta said that the situation surrounding the Rs 2,000 notes differs significantly from the large-scale demonetisation exercise that took place in India previously. Unlike the previous demonetisation, which involved the withdrawal of high-value currency notes, the current scenario does not aim to eliminate the Rs 2,000 denomination altogether. Instead, it seeks to manage and assess the circulation of these notes more effectively.

However, one aspect that raises question is the fate of Rs 2,000 notes beyond September 30. The precise course of action regarding these high-denomination notes remains ambiguous.

"It is essential to note that the Indian government has not provided clear directives or guidelines concerning the future of the Rs 2,000 notes. The lack of clarity leaves room for speculation and uncertainty among businesses, individuals, and financial institutions," Sengupta said.

“What is clear, as of now, is that holders of these bank notes may deposit any amount of the notes to the banks or to the RBI officers and exchange up to Rs 20,000 at a time from May 23 to September 30. The notification has said without specifying a date that the bank notes in Rs 2,000 denomination will continue to be legal tender," Sengupta said.

For more details, watch the accompanying video