The Reserve Bank of India (RBI) may have left the benchmark repo rate unchanged for the sixth review in a row, but it wants the country's banks to push up the lending rates because inflation is well beyond the level the central bank's comfort zone and may remain so through the whole of 2024.

Shares of top lenders like HDFC Bank, ICICI Bank, Axis Bank and Kotak Mahindra Bank saw a sharp fall in trade right as RBI Governor Shaktikanta Das concluded his address post the latest monetary policy review.

#CNBCTV18Market | Banks under pressure, ICICI, Axis Bank down more than 2% pic.twitter.com/UfT0QVkPKh

— CNBC-TV18 (@CNBCTV18Live) February 8, 2024

How do interest rates affect inflation?

The central bank hikes interest rates to reduce inflation. The RBI had increased rates by 250 basis points between May 2022 and February 2023. Governor Das's contention is that not all of it has been passed on.

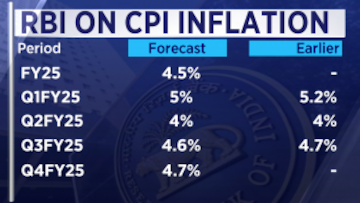

Inflation in India has cooled down — from an average of 6.7% in 2022 — but not enough for the central bank to lower its guard. As shown above, retail is expected to be between 4.5% to 5% throughout the year.

Das has clearly expressed his intent to tame inflation down to his stated target of 4% or less. The latest consumer price index (CPI) for December 2023 showed an inflation of 5.69%, the highest in the preceding four months.

While the RBI expects inflation to cool down in the months ahead, its estimates show that the price rise is going to be stronger than what it'd like i.e. 4% or less. Why is it so?

RBI will not rest until inflation is back at 4%, the message from Governor Shaktikanta Das

Lending rates in the credit market have not increased proportionately, the RBI Governor highlighted in his address after the latest monetary policy review where the interest rates were left unchanged for the sixth time in a row.

When interest rates rise, people borrow less and spend less, keeping prices in check. "They want to see some amount of disinflation," R Sivakumar, Head Fixed Income, Axis Asset Management Company, told CNBC-TV18.

But if the price rise, as per RBI estimates, is going to be 4.7% even in the October to December 2024 quarter, how effective is the policy transmission?

Transmission is a word used to describe the increase or decrease in lending rates following the changes to repo rate set by the RBI. Simply put, lending rates have to rise further.

What is the RBI really worried about?

Disinflation describes a slower increase in prices. Governor Das' worries stem, in particular, from the volatility in food prices. Food inflation in December stood at 9.53%. The rise in vegetable prices was 27.64% a lot higher than the 17.7% (which is a high number too) a month earlier.

ALSO WATCH: RBI Governor's address after the latest monetary policy review

Why the inflation rate matters for the stock market?

Stock market investors and traders like rate cut because it releases more money into the system that takes prices of risky investments like stocks higher.

The emphasis on inflation rate is important for equity markets too. "when they are really there at around 4%, they may change the stance and cut rates. So those are the areas where I think the markets will have to wait, before we can see the liquidity easing and also rate cuts," Sanjay Parekh, Founder & CIO, Sohum Asset Managers said.

Both inflation and the RBI reaction to it has other components too. "The swift turn of tone and action pivots of the RBI in the last two years have been influenced purely by global narrative. We do not see RBI preceding the Fed (US Federal Reserve) in rate cuts," Madhavi Arora, Chief Economist at Emkay Global, said.

First Published: Feb 8, 2024 12:27 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

BJP's Hindi heartland dominance faces test in phase 3 polls

May 2, 2024 9:14 PM

Lok Sabha Election: Re-elections at a Ajmer booth after presiding officer misplaces register of voters

May 2, 2024 4:54 PM