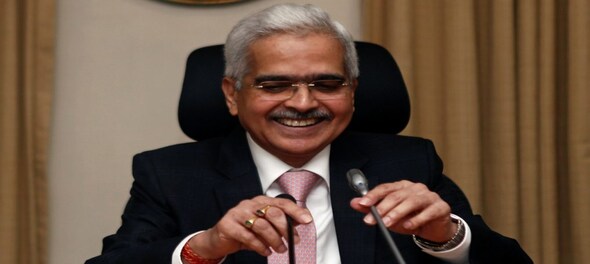

The Reserve Bank of India will soon be launching interoperability of digital payment systems for Internet banking to ensure faster fund settlements for merchants, Governor Shaktikanta Das said on Monday addressing the media at the inauguration of Digital Payment Awareness Week at the central office in Mumbai.

"We expect the launch of this interoperable payment system for Internet banking during the current calendar year. The new system will facilitate quicker settlement of funds for merchants," he said while adding that the approval has been given to NPCI Bharat BillPay Ltd, to implement the system.

Governor Das further explained that there is no common payment system and a set of rules for digital transactions at the moment. "Transactions processed through Payment Aggregators (PAs) are not interoperable, i.e., a bank is required to separately integrate with each PA of different online merchants."

"As a result, if a customer wants to make a payment from his bank account to a certain merchant, the merchant’s PA and the customer’s bank must have an arrangement. Given the multiple number of payment aggregators, it is difficult for each bank to integrate with each PA. Further, due to the lack of a payment system and a set of rules for these transactions, there are delays in the actual receipt of payments by merchants and settlement risks."

Governor Das also said that when it comes to digital transactions, the world is looking at India. "India now holds a dominant position on the global stage, contributing nearly 46% of the world's digital transactions, UPI transactions now account for 80% of all digital payments in India. In 2012-13, there were 162 crore digital payments. This number has grown to 14,726 crore in 2023-24 till February, showcasing a 90-fold growth in 12 years," he added.

Meanwhile, the RBI has launched a week-long Digital Payment Awareness program intending to create awareness around the safety and security of digital payments.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

'Borrowed' leaders: Congress hits out at AAP for not fielding their own candidates in Punjab

Apr 28, 2024 9:53 PM

EC asks AAP to modify election campaign song and Kejriwal's party is miffed

Apr 28, 2024 9:25 PM