The Reserve Bank of India (RBI) on Friday announced its decision to discontinue the Incremental Cash Reserve Ratio (I-CRR) in a phased manner. This decision comes after a careful assessment of current and evolving liquidity conditions in the financial market.

The I-CRR, which was introduced as a temporary measure to manage surplus liquidity, required scheduled banks to maintain a 10 percent reserve on the increase in their net demand and time liabilities (NDTL) between May 19, 2023, and July 28, 2023. The measure was implemented to absorb excess liquidity generated by various factors, notably the return of Rs 2,000 notes to the banking system.

The RBI had initially indicated that the I-CRR would be reviewed on September 8, 2023, or earlier, with the intention of returning the impounded funds to the banking system ahead of the festival season. Following this review, the central bank has decided to discontinue the I-CRR in a phased manner to ensure that system liquidity remains stable and money markets function in an orderly manner.

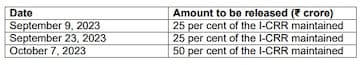

"Based on an assessment of current and evolving liquidity conditions, it has been decided that the amounts impounded under the I-CRR would be released in stages so that system liquidity is not subjected to sudden shocks," the central bank said.

The release of funds would be as follows:

Lakshmi Iyer, CEO - Investment & Strategy at Kotak Alternate Asset Managers Limited, commented on the RBI's decision, saying, "On our poll also I mentioned that a calibrated withdrawal seems to be the need of the art, and I think that's exactly what they have done. It's good because from the time this was announced, that incremental system liquidity has actually receded, and if they would have continued then it would have meant a much tighter, third or fourth week of September in terms of liquidity, which probably may not have gone too well. So, I think this is pretty much in line with expectations."

Calling the decision a relief for bankers, Ashutosh Khajuria, Executive Director at Federal Bank said, "The deposit of Rs 2,000 denomination currency notes in the form of deposits rather than exchange had increased liquidity in the system. On the other hand it is a fact that during festive season there would be a need of more liquidity in the system because part of it would get leaked through increase in circulation of currency notes.”

"As long as there is competition amongst the banks and that is pushing the deposit rates up - ultimately it is not impacting the liquidity," he told CNBC-TV18.

Manoranjan Sharma, Chief Economist at Infomerics Ratings inputs stated that RBI's step is of greater significance in the light of the fact that historically, the liquidity gets squeezed in the October- December season.

The I-CRR, similar to the Cash Reserve Ratio (CRR), required banks to set aside a portion of their funds with the RBI. However, the I-CRR specifically targeted the increase in net demand and time liabilities during the specified period.

The RBI's phased discontinuation of the I-CRR is likely to have implications for liquidity management and interest rates in the Indian financial system, and it will be closely monitored by market participants and economists in the coming months.

First Published: Sept 8, 2023 2:26 PM IST