Shares of major banking and non-banking finance companies, such as Bajaj Finance, HDFC Bank, ICICI Bank, and SBI Card, witnessed a decline of up to 6% on November 17, Friday. This drop followed the Reserve Bank of India's (RBI) implementation of stricter norms for personal loans and credit cards in the form of higher capital requirements.

Brokerages say the new norms will make personal loans and credit cards costlier and may curb growth in these categories.

The new regulations entail a 25-percentage-point increase in risk weights for banks and NBFCs, necessitating a higher capital requirement for each loan issued. Specifically, the risk weight on retail loans, covering personal loans and credit card loans, has been upped to 125%, up from the earlier 100%. The housing, education and vehicle loans as well as loans secured by gold and gold jewellery will be excluded, the RBI said.

Here's what different brokerages say:

BoFA Securities

The brokerage said increased risk weight on unsecured consumer credit, credit cards, and NBFC lending for banks might have a limited impact on housing finance companies (HFCs). They anticipate potential improvements in pricing and discipline within the unsecured lending space. However, they highlighted the State Bank of India (SBI) as potentially facing the most significant impact due to its comparatively lower capital base.

CITI

The brokerage weighed in, emphasising the adverse effects on CET-1 (Common Equity Tier-1) for several banks as a result of increased risk weights on unsecured credit. They specified expected reductions in CET-1, with RBL facing a 75 basis points decline, HDFC Bank at 50 basis points, ICICI Bank at 42 basis points, Axis Bank at 36 basis points, and similar impacts on other banks.

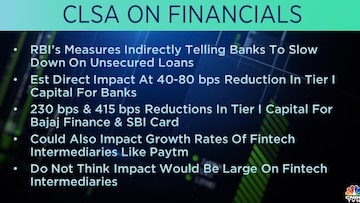

CLSA

The brokerage anticipated a reduction of 40-80 basis points in Tier I capital for banks due to the RBI's measures. They highlighted the indirect indication from RBI to banks to slow down on unsecured loans and estimated the potential impact on major financial institutions such as Bajaj Finance and SBI Card, with reductions of approximately 230 basis points and 415 basis points, respectively.

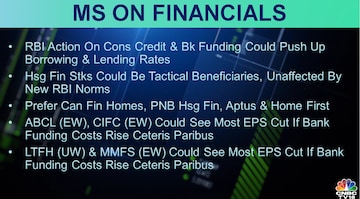

Morgan Stanley (MS)

The brokerage focused on the potential consequences of the RBI's actions, suggesting that they could push up borrowing and lending rates within the financial landscape. They also highlighted a potential tactical advantage for housing finance stocks as they remain unaffected by the new RBI norms, suggesting preferences for Can Fin Homes, PNB Housing Finance, Aptus, and Home First.

HSBC

HSBC highlighted the additional capital consumption expected for banks and NBFCs, estimated at 40-80 basis points. They mentioned specific institutions like Bajaj Finance, SBI Cards, and Ujjivan Small Finance Bank as potential outliers likely to be more impacted. They also anticipate an increase in loan pricing for NBFCs and personal loans, with SBI Cards expected to face the most substantial impact.

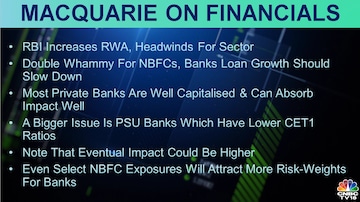

Macquarie

The brokerage underlined the headwinds expected for the sector due to the increased Risk-Weighted Assets (RWA), projecting a potential slowdown in loan growth, especially for NBFCs. They emphasised that while most private banks are well-capitalised and can absorb the impact, the lower CET1 ratios of PSU banks pose a more considerable concern. They also warned about the potential higher eventual impact, particularly on select NBFC exposures, resulting in more risk weights for banks along with top-up loans against movable assets.

(Edited by : Amrita)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Exclusive | Full text of the PM interview: Modi's agenda for the next 5 years

Apr 29, 2024 10:28 PM

PM Modi says he’s going forward with a positive attitude as a response to personal attacks

Apr 29, 2024 10:08 PM