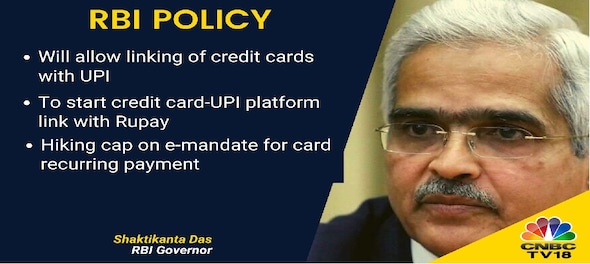

Reserve Bank of India (RBI) Governor Shaktikanta Das said on Wednesday that the linking of the Unified Payment Interface (UPI) with credit cards would be allowed soon, and those with RuPay credit cards would get the benefit first.

During the June Monetary Policy Committee (MPC) meeting, Das said this would increase convenience for users and enhance the scope of digital payments. Currently, users can make UPI payments only by linking savings or current accounts through debit cards.

The RBI governor said on Wednesday that UPI had become the most inclusive mode of payment in India. "Currently, over 26 crore unique users and 5 crore merchants are on the UPI platform. In May 2022 alone, 594.63 crore transactions amounting to Rs 10.40 lakh crore were processed through UPI," he said.

"To further deepen the reach and usage, it is proposed to allow linking of credit cards to UPI. To start with, RuPay credit cards will be enabled with this facility," he said.

The RBI governor said this facility would be available after the required system development is complete. "Necessary instructions will be issued to the National Payments Corporation of India (NPCI) separately," Das said.

As per a note from Equirus, those on Visa or Mastercard networks were already making payments through Google Pay but only to merchants. The note said that one could use their credit or debit card via GPay at tap-and-pay NFC-enabled terminals, for Bharat QR code-based payments, bill payments, recharges, and online payments on Myntra, Dunzo, Yatra, MagicPin, Coolwinks, EaseMyTrip, and Confirmtkt android apps.

It is not clear yet if UPI payments from person to person through credit cards would be made possible after the RBI decision. According to some reports, if this is made possible, credit card companies might have issues charging a merchant discount rate (MDR). The Equirus note states: "In credit card payments made over UPI, MDR continues to get charged as per card variant."

On e-mandate

The RBI governor also said that the cap on e-mandate for card recurring payments would be hiked from Rs 5,000 to Rs 15,000 per recurring payment.

Shaktikanta Das said the RBI was getting requests from stakeholders to increase the limit under the framework to facilitate payments of larger value like subscriptions, insurance premia, education fees, etc.

"Major banks are providing the facility, and the transaction volumes are seeing good traction. To date, over 6.25 crore mandates have been registered under this framework, including for over 3,400 international merchants. Requests have been received from stakeholders to increase the limit," he said.

"To further augment customer convenience and leverage the benefits available under the framework, it is proposed to enhance the limit from Rs 5,000 to Rs 15,000 per recurring payment. Necessary instructions will be issued shortly," he said.

S K Ghosh, Group Chief Economic Advisor to SBI, said, "MSP hike for the Kharif crops, there will be an upside pressure of 15 to 20 bps on inflation."

(Edited by : Akriti Anand)

First Published: Jun 8, 2022 11:29 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

PM Modi visits Ram Mandir for first time since 'Pran Pratishtha', offers prayers before roadshow

May 5, 2024 8:59 PM

Visiting temples, obliging selfie requests, jabbing rivals – Kangana Ranaut is wooing voters on campaign trail

May 5, 2024 8:23 PM