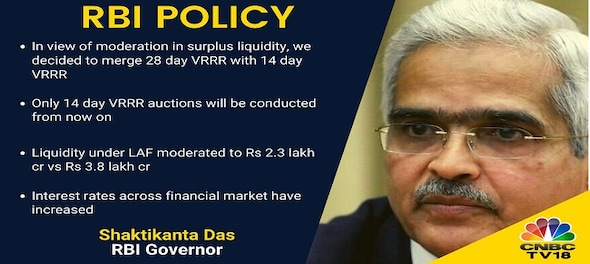

Reserve Bank of India (RBI) governor Shaktikanta Das said on Friday that the central bank had decided to merge the 28-day variable rate reverse repo (VRRR) with the 14-day main auction, considering the current banking system liquidity conditions. VRRR is usually undertaken to reduce money flow by taking out existing cash present in the system.

"Only 14-day VRRR auctions will be conducted from now on. Fine-tuning operations of various maturities will be conducted for injection as well as absorption of liquidity as may be necessary from time to time," he said while making the monetary policy announcements.

Shaktikanta Das said the excess cash reserve ratio (CRR) and statutory liquidity ratio (SLR) holdings of banks can supplement liquidity. He added that interest rates across the financial market have increased, and liquidity under LAF has been moderated to Rs 2.3 lakh crore versus Rs 3.8 lakh crore.

"The goods and services tax (GST) collections moderated liquidity position," he said.

India's banking system liquidity slipped into deficit earlier this month and has largely remained that way since then. It currently stands at a deficit of $2.29 billion. The liquidity is likely to remain in deficit in the second half of this financial year as credit growth picks up and the circulation of currency notes rises, analysts said.

The RBI has been conducting 28-day VRRR auctions for Rs 500 billion since November 2021, but these auctions have not been fully subscribed for the last few months.

The RBI also conducts 14-day VRRR auctions for Rs 2 trillion, and these, too, have failed to attract complete subscriptions in the last few weeks.

Meanwhile, RBI has raised the benchmark lending rate by 50 basis points to 5.90 percent in a bid to check inflation. With the latest hike, the repo rate or the short-term lending rate at which banks borrow from the central bank, is now close to 6 percent.

This is the fourth consecutive rate hike after a 40 basis points increase in May, and 50 basis points hike each in June and August. Overall, RBI has raised benchmark rate by 1.90 per cent since May this year.

-With PTI inputs

Catch latest RBI policy updates with CNBCTV18.com's blog

First Published: Sept 30, 2022 10:38 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!