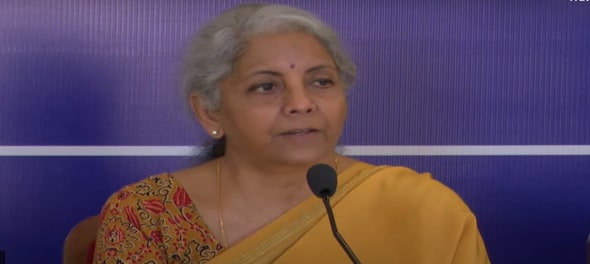

Finance Minister Nirmala Sitharaman on Monday said the government's efforts to reduce bad loans are yielding results with 12 public sector banks reporting a 50 percent jump in combined net profit at Rs 25,685 crore in the September quarter.

In the first half of FY23, the cumulative net profit of all public sector banks (PSBs) increased by 32 percent to Rs 40,991 crore.

During the second quarter, the SBI reported the highest-ever profit of Rs 13,265 crore. On year-on-year basis, this was 74 percent higher than the same quarter a year ago.

Finance Minister Nirmala Sitharaman in a tweet said that all 12 public sector banks declared a net profit of Rs 25,685 crore in the September quarter and a total Rs 40,991 crore in the first half of this fiscal, both were up 50 percent and 31,6 percent, respectively, from the same period last fiscal.

The continuous efforts of our govt for reducing the NPAs & further strengthening the health of PSBs are now showing tangible results. All 12 PSBs declared net profit of Rs 25,685 cr in Q2FY23 & total Rs 40,991 cr in H1FY23, up by 50% & 31.6%, respectively (y-o-y).(1/2)

— Nirmala Sitharaman (@nsitharaman) November 7, 2022

She added that Canara Bank reported an 89 percent jump in profit to Rs 2,525 crore as compared to the second quarter of the previous fiscal.

Also Read: After record earnings, SBI confident of mirroring double-digit credit growth in banking system

Kolkata-based UCO Bank posted a 145 percent surge in profit to Rs 504 crore while Bank of Baroda's profit increased by 58.7 percent to Rs 3,312.42 crore in the second quarter, she said in an another tweet.

Two of the 12 lenders — Punjab National Bank (PNB), and Bank of India — reported decline in profits ranging from 9-63 percent. These lenders' declining profits have been ascribed to higher provisioning for bad loans.

PNB said the main reason behind the decline in the net profit was higher provisioning towards bad loans. The bank's provisioning for the September quarter rose to Rs 3,556 crore, as against Rs 2,693 crore in the same period last fiscal.

Meanwhile, Bank of India (BoI) said total provisions doubled to Rs 1,912 crore in the quarter from Rs 894 crore a year ago. A majority of the provisions came on standard accounts belonging to state governments in which payments were delayed and hence provisions had to be made after a Reserve Bank of India (RBI) inspection.

Ten lenders have recorded profit ranging from 13-145 percent during the second quarter of this fiscal year. The highest percentage growth were recorded by UCO Bank and Bank of Maharashtra at 145 percent and 103 percent over the same quarter of previous fiscal.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Elections | Why Kerala is in focus as the second phase begins to vote

Apr 26, 2024 9:33 AM

Bengaluru Rural Lok Sabha election: Over 8% voter turnout recorded by 9 am

Apr 26, 2024 9:11 AM