The financial industry has lately been raising concerns about the potential buildup of credit risk in the realms of personal loans and credit card lending. Cautioning about this trend, India's leading banking and finance experts pointed out several aspects contributing to the evolving credit landscape in their interaction with CNBC-TV18.

The rise in credit risk

Saswata Guha, Senior Director, Fitch Ratings, said in an exclusive interview that increasing risk in unsecured retail lending, pressure on margins due to funding costs, rising demand for personal loans, challenges in tracking the end use of funds for unsecured loans, indirect exposure to banks via the NBFC route, and the relatively higher ticket size of bank loans compared to NBFCs are the key concerns.

AM Karthik, Vice President, ICRA, echoed these concerns about personal loans, citing substantially higher write-offs, the expectation of 4-6 percent losses, higher credit costs, and a rapid growth rate in disbursements.

Jayaram Sridharan, Managing Director, Piramal Capital and Housing Finance, also pointed out a looming credit cycle, specifically referring to unsecured loans, particularly personal loans.

While speaking at the CNBCTV-18 Banking Summit, Sridharan said that secured lending risks appear to be subsiding but unsecured lending, represented by personal loans and credit cards, seems to be undergoing more complex dynamics. Sridharan highlighted that data indicates a downward trend in secured lending risk but noted a fluctuating pattern in the case of personal loans and credit card lending.

Within the category of personal loans, smaller ticket loans have experienced an increase in risk. However, it's worth mentioning that microfinance institutions (MFIs) might not be as affected by these trends, according to Sridharan.

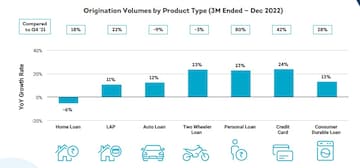

Notably, unsecured retail loans grew at a CAGR (compounded annual growth rate) of 47 percent from March 2021 to March 2023 led by digital and information-oriented small ticket lending, TransUnion CIBIL’s Credit Market Indicator (CMI) report last month showed. Similar trends were seen in 2022 too.

(Source: TransUnion CIBIL report)

The counter-perspective

Ramesh Iyer, Vice Chairman and MD, Mahindra Finance, offered a counter-perspective, suggesting that these trends might not be uniform across the board. He mentioned that Mahindra Finance's focus on regular and secured loans could explain why their observations differ from the trends described by Sridharan.

The debate also encompasses the concept of intentional or circumstantial

defaulters during credit cycles. While non-performing assets (NPAs) might largely be circumstantial, Ramesh Iyer noted that the struggle primarily revolves around a smaller portion of borrowers who intentionally default, emphasising that the majority of borrowers do repay their loans.

Even earlier, Ambuj Chandna of Kotak Mahindra Bank, addressed the issue in a conversation with Moneycontrol, stating that the increase in risks hasn't affected the affordability of home loans and that the demand for home ownership remains robust. He dismissed the notion of an "Uberisation" of homes, suggesting that people are more inclined to buy homes rather than rent due to changing economic conditions.

The credit landscape

The

Reserve Bank of India (RBI) has, however, shown concern by urging banks and NBFCs to exercise caution in the retail lending sector, especially when it comes to unsecured loans. This concern might stem from the observable rise in personal loans and credit card usage, along with a slight decline in collection efficiency and an increase in delinquency for personal loans.

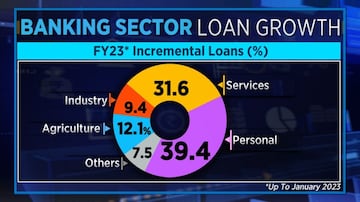

CIBIL's data, particularly for the last quarter of 2022, indicated a decline in secured home loans but a significant rise in unsecured personal loans and credit card lending. The increase in collection efficiency and delinquency rates further underscored the need for prudent lending practices.

The central bank's data from last month also highlights the continued growth in credit card spending by Indians. According to recent statistics, credit card spending in May of this year reached a significant milestone, hitting a record high of Rs 1.4 lakh crore. An analysis further showed that the total spending or outstanding dues on credit cards, which remained relatively stable throughout the previous fiscal year, have been steadily increasing by five per cent month-on-month in the current year.

The bottomline

The landscape of personal loan and credit card lending is undergoing a dynamic shift, with varying perspectives on credit risk. While some experts point to potential vulnerabilities, others emphasise the need for responsible lending practices to sustain growth in the sector. The concerns raised by industry leaders and regulators highlight the importance of vigilance and thoughtful risk management in the evolving credit environment.

(Edited by : C H Unnikrishnan)

First Published: Aug 25, 2023 3:47 PM IST