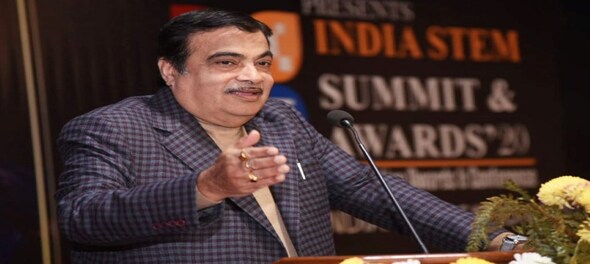

Private sector Bajaj Allianz General Insurance on Monday, December 19, said Union Road Transport and Highways Minister Nitin Gadkari launched one of India’s first-ever surety bond insurance products. According to the company, it developed this product in response to a demand identified by the industry and the government. The product launch is in line with the government's vision to upscale infrastructure development in the country to increase the pace of development of upcoming projects.

Surety bond insurance will act as a security arrangement for infrastructure projects and will insulate the contractor as well as the principal. The product will cater to the requirements of a diversified group of contractors, many of whom are operating in today’s increasingly volatile environment.

Surety bond insurance is a risk transfer tool for the principal and shields them from the losses that may arise in case the contractor fails to perform their contractual obligation. The product gives the principal a contract of guarantee that contractual terms and other business deals will be concluded in accordance with the mutually-agreed terms.

In case the contractor does not fulfil the contractual terms, the principal can raise a claim on the surety bond and recover the losses they have incurred. Unlike a bank guarantee, the surety bond insurance does not require a large collateral from the contractor, thus freeing up significant funds for the contractor, which they can utilise for the growth of the business.

Gadkari said, "With this new instrument of surety bonds, the availability of both liquidity and capacity will definitely be boosted; such products stand to strengthen the sector."

The product will also help in reducing the contractors’ debts to a large extent thus addressing their financial worries. The product will facilitate the growth of upcoming infrastructure projects in the country.

Tapan Singhel, Managing Director and Chief Executive Officer of Bajaj Allianz General Insurance, said surety bond insurance will prove to be an effective tool for the industry and will allow contractors to take up more projects as the product will help them optimise capital.