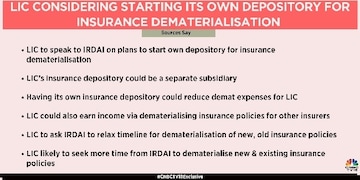

The Life Insurance Corporation (LIC) is considering starting its own depository for insurance dematerialisation, sources informed CNBC-TV18.com.

"LIC’s insurance depository could be a separate subsidiary. This would reduce demat expense for LIC. They would also earn income via dematerialising insurance policies for other insurers," sources said.

LIC is also planning to ask Insurance Regulatory and Development Authority of India (IRDAI) to relax timeline for dematerialisation of new and old insurance policies.

As far as the expense incurred on dematerialization of policies for LIC is concerned, LIC has around 75 percent market share when it comes to total insurance policies in the industry. It issues nearly two crore policies each year.

Also there are 22 crore policies which are active and existing belonging to LIC in the industry today. So, if this was to be done through a different subsidiary, let's say a CAMS or National Securities Depository Limited (NSDL), Central Depository Services (CDSL), then LIC would have incurred around Rs 1,200 crore to Rs 1,400 crore on dematerialization of policies.

But, now that money will be coming to its own subsidiary, LIC will also be allowed to take dematerialization business from other life insurance companies and other insurance companies.

Dematerialisation means converting physical policy document into a modifiable online object. It means that a person will no longer need to indulge in paperwork at time of renewing the policy. It is aimed at reducing transaction costs and also ensuring swift modifications in policies.

(Edited by : Anshul)

First Published: Sept 15, 2022 3:24 PM IST