In a move which could take out a major overhang for life insurance companies, the Insurance Regulatory and Development Authority of India (IRDAI) is likely to consider rationalisation on proposed higher surrender value.

IRDAI, in December 2023, released a consultation paper proposing to increase surrender value paid by life insurance companies to its policyholders, thereby reducing surrender charges charged by these life insurance companies.

The intention of the insurance regulator was to give higher benefits to policyholders in case of a life insurance policy being voluntarily surrendered before its maturity by a policyholder. The proposal from

IRDAI spoke about a significant increase in surrender value and a reduction in surrender charges which is being viewed as a big negative for life insurance companies.

Brokerages estimate a 400-500 bps hit on the margins for life insurance companies.

The surrender value paid by life insurance companies to its policyholders could almost double, if the insurance regulator’s proposal is implemented in the form that it has been proposed.

Sources tell CNBC-TV18 that after multiple representations made by individual life insurance companies as well as the Life Insurance Council (LIC), IRDAI is ready to consider rationalisation of proposed surrender value.

The intention, while reviewing the proposed surrender value, would be to provide higher benefits to policyholders and limiting burden on life insurance companies.

As per sources, two important aspects of proposed surrender value are being considered by IRDAI towards its rationalization exercise.

Distinction between long-term and short-term surrenders

The life

insurance industry had recommended a distinction between long and short-term surrenders.

As per sources, IRDAI is considering the life insurance industry’s suggestion on keeping the calculation of surrender value the same way as its done currently for policies surrendered before 5 years, irrespective of the life of that life insurance policy.

A higher surrender value can be given to polices surrendered post 5 years.

If the change is made then it will be a big positive for life insurance companies, as the surrender post five years are very limited and hence the impact of higher surrender value would also be very limited.

Reduction of threshold for calculation of surrender value

As per sources, IRDAI is also likely to consider reduction of threshold for calculation of surrender value. If threshold limits is brought down then surrender value will also come down.

According to sources, steps to rationalise proposed surrender value are likely to be considered in IRDAI’s March board meeting.

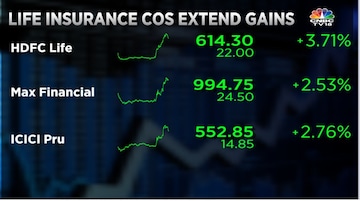

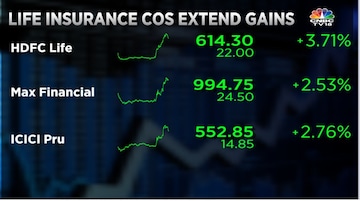

Stock movement

In wake of this development, life Insurance companies were trading with gains.

HDFC Life rose over 3.5% on reports that IRDAI may consider rationalising proposal w.r.t surrender value.

(Edited by : Anshul)

First Published: Mar 4, 2024 1:38 PM IST

HDFC Life rose over 3.5% on reports that IRDAI may consider rationalising proposal w.r.t surrender value.

HDFC Life rose over 3.5% on reports that IRDAI may consider rationalising proposal w.r.t surrender value.