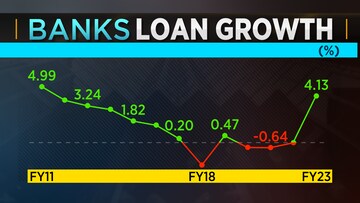

The banking sector has witnessed its strongest first-quarter business growth in the last 12 years. Loan growth has bounced back as banks, till July 1, have seen strong growth of over 4 percent compared quarterly.

If one looks at the historical loan growth, it shows that the sector recorded negative growth in the past three fiscal years in the quarter one period. So in terms of absolute value as well, the loans this year have seen the highest quarter-one increase over quarter-four increase in the last 13 years.

The incremental credit growth in quarter one of the current financial year (FY23) on a sequential basis has been about Rs 4.91 lakh crore. Now, compared to the previous year, this is almost halfway mark in the first quarter itself.

This is on the back of robust demand that is being seen across sectors and despite the fact that capex demand is yet to take off fully, this number is impressive.

On a sequential fortnightly basis, the total credit growth saw the food credit growth reading decline but the non-food credit growth rose well. There has been a healthy growth in deposits as well. Deposits grew by 2.4 percent on a fortnightly basis.

Annually, the food credit is down by 55 percent and non-food credit growth has picked up to about 14 percent.

Given the steady growth in both credit and deposit, the credit deposit ratio has remained almost static at 73 percent, which compares to about 70.75 percent in the previous fiscal.

As things stand, barring any impact of a global slowdown, Indian credit and deposit growth or the business growth of the banking sector look robust.

According to Sunil Mehta, Chief Executive at Indian Banks' Association, this is an indicator that economic activity is bouncing back to the pre-pandemic level and even better than that in some of the sectors.

“The corporate sector was shying away from the fresh investments during the pandemic. Now they are coming out with new projects. I think they feel more confident about the state of affairs continuing... So by and large, the growth is broad-based and every segment has contributed to it,” he said.

Digant Haria, Co-Founder of Greenedge Wealth concurred with Mehta’s views. “The working capital demand is coming back. So I think corporate growth is going to be the game changer this year. Last year, it was negative. This year, it's definitely not going to be negative. And hence, I think corporate-focused banks are going to be a little more in the sweet spot this year,” he added.

For the entire discussion, watch the accompanying video

(Edited by : Abhishek Jha)

First Published: Jul 21, 2022 2:10 PM IST