Indian Bank on Friday said it has embarked on a hiring spree by recruiting talent from the private sector to infuse fresh expertise and perspectives into its workforce. By bringing in professionals from the private sector, the bank aims to bolster its operational efficiency, enhance customer experiences and adapt to the rapidly evolving banking landscape.

In an interview with CNBC-TV18, Shanti Lal Jain, MD and CEO of Indian Bank spoke at length about bank's strategic initiatives and financial projections for the fiscal year 2024.

The strategic decision to recruit talent from the private sector aligns with Indian Bank's goal to embrace innovation and adapt to the ever-changing demands of the

banking industry.

“We have started taking people from private sector. We have taken people for IT, cyber securities, and all. In some areas you need expertise, you need a competence. Therefore, we are taking from the market as well,” said Jain.

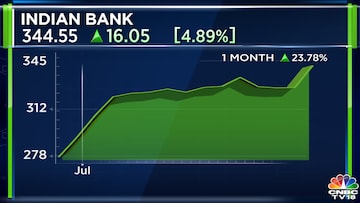

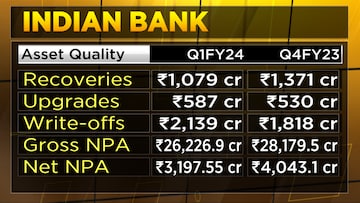

Indian Bank also announced a strong set of Q1FY24 earnings with sound operational performance. The bank witnessed an enhancement in its net interest margin and observed a notable sequential decline of approximately 28 percent in slippages.

While discussing about the bank's financial outlook, Jain expressed optimism about the recovery prospects for FY24. He projected that the bank's recoveries during the fiscal year would reach an impressive figure of approximately Rs 8,000 crore. This indicates a strong focus on resolving non-performing assets and retrieving dues, which can have a positive impact on the bank's overall

financial health and profitability.

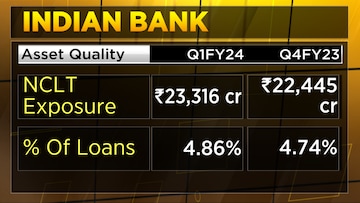

Jain also spoke about Indian Bank's exposure to the National Company Law Tribunal (NCLT) cases. He revealed that the bank's NCLT exposure currently stands at over Rs 23,000 crore.

For more details, watch the accompanying video