Housing Development Finance Corporation (HDFC) and HDFC Bank are eyeing clearance from the RBI for their mega-merger, which, if materialises, will create one of the largest lenders in the world in terms of market value. According to HDFC Bank's management, the proposed amalgamation has the "blessings" from the RBI, which had directed both financial institutions to keep the merger simple.

In an analysts’ meeting on Tuesday, HDFC Bank’s management said the merger of this scale had the blessings of the regulator. However, since tax neutrality is not resolved, the lender said RBI has asked it to keep the structure of the merger simple.

Tax neutrality means the structure of the lender should not lead to a duplicative layer of taxes borne by investors.

When HDFC's board approved the merger in April this year, its CEO Keki Mistry had said "there were regulatory barriers for the HDFC-HDFC Bank merger earlier. The RBI had mandated that one entity may be engaged in a specific product line."

In November 2020, an RBI panel had suggested that a non-operative financial holding company (NOFHC) should continue to be the preferred structure for all new licenses to be issued for universal banks. However, it should be mandatory only in cases where the individual promoters/ promoting entities/ converting entities have other group entities.

As HDFC twins gear up for the merger, here’s a look at the lender’s key focus points

Doubling of balance sheet

HDFC Bank’s management on Tuesday said that doubling of balance sheet every five years post the merger was not an issue for the bank.

“Bank plans to double loan book every five years even post-merger. Liabilities remain extremely important to growth, and could be the only limiter,” Dolat Capital said in its research report on the bank’s analyst day event.

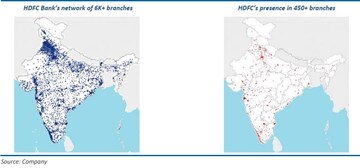

The lender will therefore be aggressive in branch expansion, adding 1,500-2,000 branches per year for the next three years to double the distribution network.

| Geography | Branches | Customer Service Centres Business Correspondents | Other BCs | Total banking outlets |

| Rural | 1,147 | 2,642 | 204 | 3,993 |

| Semi-urban | 2,036 | 8,293 | 88 | 10,417 |

| Urban | 1,312 | 3,330 | 3 | 4,645 |

| Metro | 1,847 | 781 | 0 | 2,628 |

| Total | 6,342 | 15,046 | 295 | 21,683 |

Source: HDFC Bank

Employee culture

HDFC Bank said it is focused on ensuring the right employee culture that includes no hiring or firing, no use of slang language by bosses, handholding employees to do the work better, and respect for its employees.

The bank is working on a daily basis on the above parameters, it said in the analysts' meet.

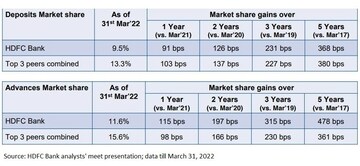

Increased market share

The lender has demonstrated market share gain consistently against its next three large competitors. Here’s how it fared against competitors. HDFC Bank has a 9.5 percent share of the deposits market versus the top three peers' combined share of 13.3 percent. In advances market, HDFC Bank has a market hold of 11.6 percent versus 15.6 percent of the top three players combined.

Also, the combined net worth of the organisation will be the highest in the banking sector. The lender said it would prefer banking on the corporate side due to:

–Lower spread and lower cost

– Return on assets (ROA) of 2 percent on corporate loans

– Return on equity (ROE) of 18-20 percent on corporate loans

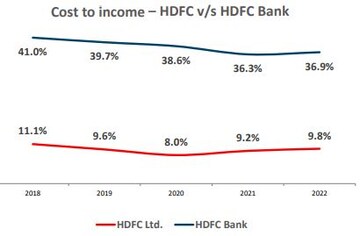

Cost to income ratio

HDFC Bank, in the analysts' meeting, said there may be some increase in cost to income ratio post the merger. However, at the same time, operating leverage will start kicking in as early as possible

Source: HDFC Bank presentation

Source: HDFC Bank presentation“Cost to income (excluding mortgages) is expected to decline to mid-30s despite investments in the employees. Expect C/I of 32 percent post-merger without operating leverage, which should moderate to 30 percent post operating leverage,” Dolat Capital explained in its report.

The first regulatory approval is likely to come by Sep-Oct, the report added.

First Published: Jun 4, 2022 8:51 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!