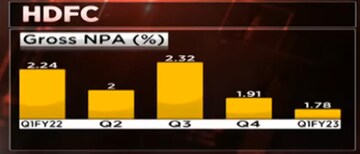

Housing finance major HDFC last week reported a mixed set of earnings for the first quarter of the financial year 2023 with the highest growth in individual loans on an assets under management (AUM) basis in the last eight years, double-digit growth in net profit, improved asset quality and six-quarter low net interest margin (NIM).

“You have seen the numbers up to June, we had a growth of 19 percent in our individual loan book, which has been the highest growth we have had in the last 8 years, which is nearly 32 quarters," said Keki Mistry, VC & CEO, HDFC, in an interview with CNBC-TV18.

Elaborating on what is driving the exceptional growth in the loan book, Mistry said that the affordability today is significantly greater than it was in 2016-2017 and income levels have particularly risen sharply in the last one year.

"The most important thing is that in the last... let's say 9-10 months, maybe a year, income levels of people have constantly kept rising. If you talk to players in certain industries like the IT industry, the e-commerce business, which you would be doing, you will find that everyone is talking of wage increases. So because of the wage increases, people's income levels, their feel-good factor, their ability, their willingness to take the plunge and buy a house is today much higher than before," he explained.

The housing finance major reported a 22 percent rise in its standalone profit after tax to Rs 3,669 crore for the quarter under review against the Rs 3,001 crore posted during the same period last year. Net interest income (NII) was up nearly 8 percent to Rs 4,447 crore from Rs 4,125 crore while the individual loan disbursement went up by 66 percent as compared to the first-quarter of FY22. NIM, however, came in at 3.4 percent, six-quarter low.

The overall AUM stood at Rs 6,71,364 crore as against Rs 5,74,136 crore on a YoY basis, with individual loans accounting for 79 percent. However, repo rate hikes taken by the Reserve Bank of India leading to increase in lending rates has had an impact on the borrowing costs.

"The full increase of 90 basis points in lending rates has not come through in the earnings up to June 30th, but the borrowing cost changes immediately. So while the borrowing cost changes immediately, the lending rates change over a period of 3 months," said Mistry. He added that going forward, the company will change lending rates every month with an agreement with the new customers.

Taking about the upcoming RBI policy announcement, Mistry said that he expects the rate hikes to not be as high as earlier envisaged.

“Now the general feeling is that the rate hikes will not be as sharp or as high as they were originally envisaged. RBI, to some extent, will also look at what the Fed is doing before they take a call on interest rates primarily because of the currency... But yes, some increase in rates is bound to happen,” he said.

HDFC stock was trading 0.26 percent lower at Rs 2,373 per share on BSE at the time of writing, falling after three consecutive sessions of gains.

The stock has gained 7.41 percent in the last one month while it is down 8.21 percent year-to-date and 2.72 percent in the last one year. The stock has underperformed the Sensex by 12.87 percent in the last one year.