Global rating agency Moody's Investors Service has said that the multiple digital outages at the country’s second-largest bank by deposits, HDFC Bank, are credit negative.

Last week, banking regulator Reserve Bank of India (RBI) had asked HDFC Bank to stop temporarily all launches under its Digital 2.0 initiative and sourcing new credit card customers. The move came after the bank experienced multiple outages in its internet banking, mobile banking and payment utility services over the past two years.

Moody’s noted that the regulator's action was in response to weaknesses in HDFC Bank's digital infrastructure and operational resilience and was credit negative because the bank is increasingly relying on digital channels to source and service its customers.

“The recurring outages also risk hurting the bank’s brand perception among a growing and increasingly digitally savvy customer base, and increases the potential that clients switch to other banks, which would lead to a reduction in revenue and low-cost retail funding,” Moody’s said in a note on Monday.

The agency does not expect the regulator’s action to materially affect the bank's existing business and financial profile but also said that the RBI action will delay the launch of HDFC Bank’s Digital 2.0 initiative.

RBI Governor Shaktikanta Das, while addressing the press briefing after the monetary policy announcement on Friday, also said that the regulator saw deficiencies in HDFC Bank's digital services and felt that HDFC Bank is required to strengthen its IT systems before expanding further.

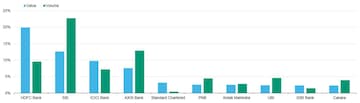

HDFC Bank leads in terms of digital transactions processed. In the fiscal year that ended in March 2020, about 95 percent of the bank’s retail transactions were conducted digitally, up from about 85 percent in fiscal 2018.

Under the Digital 2.0 initiative, HDFC Bank aims to consolidate all customers’ digital transactions, including payments, savings, investments, shopping, trade, insurance and advisory services, into one platform. Moody’s believes that this has the potential to increase spending to improve the bank’s digital infrastructure, which would strain its profitability.

At 10:45 am, the shares of HDFC Bank were trading 1.42 percent lower at Rs 1,365.45 on the BSE as compared to a 0.34 percent gain in the benchmark Sensex.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Polls Phase 3: Out of 57 candidates in West Bengal, 13 are crorepatis

Apr 30, 2024 11:38 AM

Prajwal case: Amit Shah says BJP's stand clear, won’t tolerate violence against women

Apr 30, 2024 11:31 AM

JD(S) likely to suspend Hassan MP Prajwal Revanna in sexual assault case — Latest updates

Apr 30, 2024 11:21 AM

Repolling underway in six polling booths in Outer Manipur Lok Sabha seat

Apr 30, 2024 10:25 AM