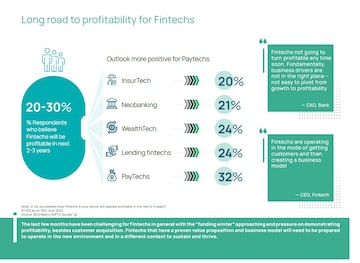

More than 70 percent of founders and CXOs believe most fintechs may not be profitable in the next two to three years owing to an increased focus on the scale as opposed to profitability and compliance, a new report shows.

In association with Boston Consulting Group (BCG), Matrix Partners India unveiled a report titled ‘State of India Fintech Union 2022’ on Thursday. The report includes results from a survey of 125+ founders and CXOs of leading fintechs and incumbents and insights from a four-part virtual panel discussion series held with industry thought leaders in July 2022.

Fintechs have made a strong contribution to the Indian economy, clocking over $800 billion annual payments transaction value, touting itself as an important segment in achieving the $5 trillion Indian economy goal.

The report addresses the future of fintechs and the sustainability of their business models amidst market uncertainties and regulatory scrutiny.

Yashraj Erande, Managing Director and Partner at BCG, said: “The sector is mission-critical for the Indian economy. Almost 36 percent of fintech customers are new-to-credit, versus 22 percent for banks."

He said “Fin” in FinTech is acquiring a bigger font, which means a greater focus should be placed on profitability and governance. "Relentless focus on innovation and customers made fintechs successful. This should continue. Nonetheless, new muscle needs to be added for newer priorities. ‘Growing together’ in partnership with incumbents and private innovation on public utilities will be key moats,” Erande said.

The survey revealed that the uncertainty brought on in the last few years due to COVID-19 has been a testing period for fintechs, while businesses were under stress and went through closure, the majority of the fintechs have survived and demonstrated their “immunity” to withstand such adverse events.

It was also found that product expansion (82 percent), improving customer service (61 percent) and hiring (75 percent) are key priorities for the industry today. Incumbents are set up to live in a two-speed world — need to build partnership BUs to drive penetration and enhance and simplify ops, tech and processes to launch agile, rapid iterative business models in partnership with fintechs.

India’s regulatory framework has been a poster child for the global financial services landscape. As our fintech landscape matures, “4C & a B” of policy enablers will go a long way in supporting the industry — Clarity & Consistency, communication, collaboration, calibration, and benchmarking to global.

The report also highlights that as the industry matures, fintechs should embrace compliance and privacy by design. It further underscores the importance of a focus on profitability from Day 1, best-in-class governance, risk management and policy enablers to ensure continued growth and innovation.

First Published: Aug 18, 2022 3:19 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM