Bank of Maharashtra is perhaps the only PSU bank to nearly double its loan book in three years. The bank has seen phenomenal improvement across parameters.

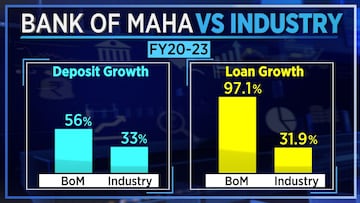

Business momentum from FY20 to FY23:

Bank has seen its deposit base rise by 56 percent in this period and credit growth of 97.1 percent. This compares to industry growth in deposits by 33 percent and loan growth of 31.9 percent in the same period.

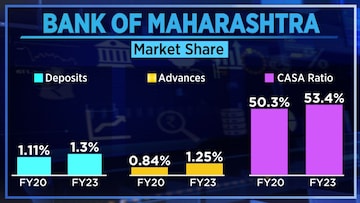

Market share in deposits have increased from 1.11 percent in FY20 to 1.3 percent in FY23. Advances market share has increased from 0.84 percent in FY20 to 1.25 percent in FY23. CASA ratio has improved from 50.3 percent in FY20 to 53.4 percent in FY23 - the highest was in FY22 at 57.85 percent.

When compared to peers, between FY20 to FY23:

Deposit market share gain has been 19 basis points (bps) for

Bank of Maharashtra, 6 bps for Federal Bank, with a decline of 19 bps for Indian Overseas Bank (IOB).

Advances market share gain has been at 41 bps for Bank of Maharashtra, 10 bps for

Federal Bank, while IOB saw a decline of 13 bps.

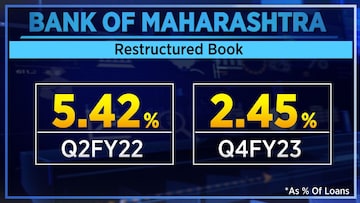

Asset quality:

Annualised quarterly slippage ratio for Bank of Maharashtra has declined from 4.42 percent in quarter four of FY20 to just 1.3 percent in quarter four of FY23. It had hit a high of 8.12 percent in quarter four of FY21.

Even its restructured book has declined from 5.42 percent of loans in quarter two of FY22 to 2.45 percent of loans in quarter four of FY23.

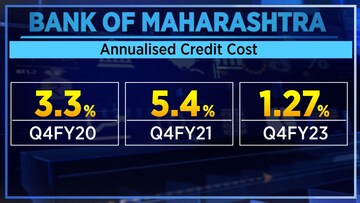

Reduction in stress is seen from the fact that its annualised credit cost, on a quarterly basis, has declined from 5.4 percent in quarter four of FY21 to 1.27 percent in quarter four of FY23. It has improved from the level of 3.3 percent in quarter four of FY20.

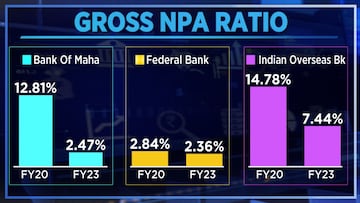

Gross non-performing assets (G-NPA) ratio has declined from 12.81 percent in FY20 to 2.47 percent in FY23. So the decline in G-NPA ratio for Federal Bank has been from 2.84 percent in FY20 to 2.36 percent in FY23 and for

IOB the decline in G-NPA ratio has been from 14.78 percent in FY20 to 7.44 percent in FY23.

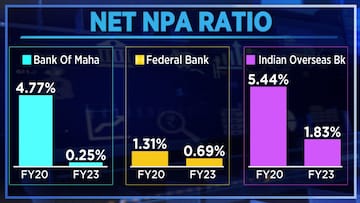

While net NPA ratio for Bank of Maharashtra has declined from 4.77 percent in FY20 to about 0.25 percent in FY23 (one of the lowest in the banking sector). For federal bank, the N-NPA ratio has declined from 1.31 percent in FY20 to 0.69 percent in FY23. And for IOB, N-NPA ratio has declined from 5.44 percent in FY20 to 1.83 percent in FY23.

P&L movement:

The net interest margin (NIM) improvement for Bank of Maharashtra from quarter four of FY20 to quarter four of FY23 has been 137 bps when compared to 90 bps improvement for IOB and 27 bps for Federal Bank.

Return on assets (RoA) improvement has been 119 bps for Bank of Maharashtra from quarter four of FY20 and quarter four of FY23. This compares to 63 bps improvement for Indian Overseas Bank and 76 bps improvement for Federal Bank.

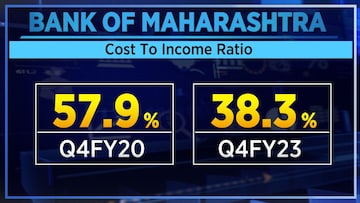

Bank of Maharashtra has also seen improvement in operating efficiency, with its quarterly cost to income ratio declining from 57.9 percent in quarter four of FY20 to 38.3 percent in quarter four of FY23; which is, one of the best in the industry.

It's a surprising fact that operating efficiency of Bank of Maharashtra is one of the best amongst PSU banks as well or may be, a rare instance where a PSU bank has its cast to income ratio below 40 percent for four quarters in a row!

Valuation:

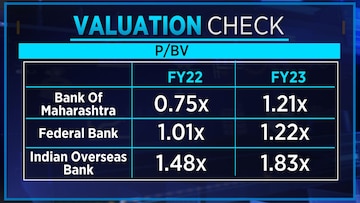

In last one year, Bank of Maharashtra's valuation has outpaced the valuation of Federal Bank. Bank of Maharashtra's price to book value, based on FY23 book value, is at 1.21 times versus 0.75 times year on year (YOY).

Federal Bank's price to book value, based on FY23 book value, is at 1.22 times versus 1.01 times YOY.

Indian Overseas Bank's price to book value, based on FY23 book value, is at 1.83 times versus 1.48 times YOY.

Year on year, stock price rise has risen by 80.1 percent for Bank of Maharashtra, 41.3 percent for Federal Bank and 54.6 percent for Indian Overseas Bank.

For more details, watch the accompanying video

(Edited by : C H Unnikrishnan)