The cost of funds for non-banking financial companies (NBFCs) could peak out in Q2FY24, per Street estimates. Consequently, net interest margin guidance from NBFC lenders is likely to improve in the coming quarters, analysts said.

However, the banking sector is expected to grapple with a rise in the cost of funds throughout the second quarter of FY24 (Q2FY24) and possibly beyond, per analysts.

The momentum in disbursals is projected to remain strong, contributing to robust loan growth for select NBFCs.

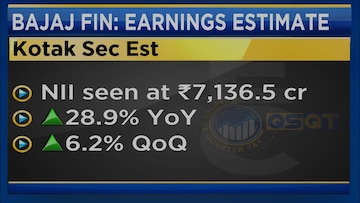

Commenting on Bajaj Finance, Digant Haria, Co-Founder of GreenEdge Wealth Services, said, "We can expect favourable results and potential stock price improvements over time, as they have surpassed the stagnant 25-28% growth rate."

In its latest business update, Bajaj Finance reported a 33% jump in assets under management (AUM) to around Rs 2.9 lakh crore as of September 30 from Rs 2.18 lakh crore the previous year.

The Bajaj Finance stock has been in the limelight after the company announced a mega fundraising plan. On October 5,

Bajaj Finance Ltd. approved raising Rs 10,000 crore through various methods.

Also Read:

Shares of Bajaj Finance were trading around half a percent lower at Rs 8,050 a piece on the NSE today. The shares have gained over 8% in the past month.

For housing finance companies, analysts said disbursals and AUM indicate healthy prospects for loan growth.

Leading players such as Can Fin Homes and PNB Housing Finance are expected to maintain steady net interest margins. In contrast, smaller players like Aavas Financiers, Repco Home Finance, and Home First Finance may witness moderate net interest margin adjustments.

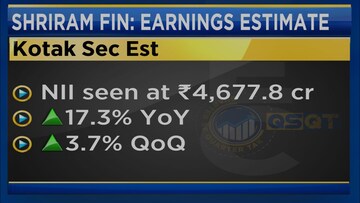

Commercial vehicle financiers, with the exception of Shriram Finance and Sundaram Finance, are poised for healthier loan growth. While Shriram Finance's shares were up at Rs 1,899.70, they have dipped by 1% over the past month.

The microfinance sector is set to be the focal point for investors. Strong disbursals are expected to drive loan growth, and the sector is relatively shielded from asset quality concerns, with the exception of Fusion Micro Finance.

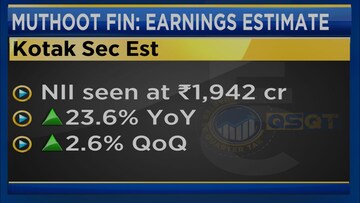

Gold financiers like IIFL Finance are projected to continue their strong growth trajectory, as seen in previous quarters. However, players like

Muthoot Finance and

Manappuram Finance may experience growth moderation due to ongoing competition from traditional banks. Nevertheless, net interest margins are expected to remain steady for all gold financiers.

Muthoot Finance's shares have risen today, currently trading at Rs 1,236.85, despite a more than 2% decline over the past month.

In the consumer finance sector, an improved macroeconomic environment is expected to drive loan growth. Nonetheless, a slight decline in net interest margins is anticipated due to rising fund costs. Fortunately, there are no looming concerns about asset quality.

Haria noted the positive performance of the commercial vehicle market and the favorable impact of RBI regulations on microfinance. He said, "NBFCs should see stable growth, stable margins, and stable asset quality, with potential nimble pressures in gold finance due to heightened competition from banks."

(Edited by : Shweta Mungre)

First Published: Oct 12, 2023 12:59 PM IST