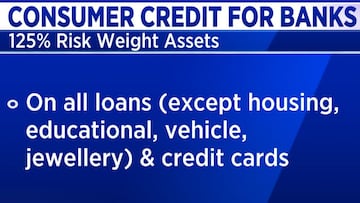

Following concerns about the rapid expansion of unsecured consumer loans, the Reserve Bank of India (RBI) introduced stricter norms on November 16. Banks and non-banking financial companies (NBFCs) are now required to increase reserves and establish board-approved policies for managing exposure limits in consumer lending. The RBI raised the risk weights for consumer credit exposure in commercial banks.

Pranav Gundlapalle, Senior Analyst-India Financials at Bernstein, pointed out the increased risks for banks lending to NBFCs, suggesting that banks might increase rates to compensate for the higher capital charge, which could pose challenges for NBFCs.

Rikin Shah, vice president of IIFL Securities, noted that this

change would affect certain banks and NBFCs, particularly ICICI Bank, RBL Bank, IDFC First Bank, and SBI, potentially impacting their capital by 40 to 100 basis points.

High-exposure NBFCs like SBI Cards, Bajaj Finance, and Poonawalla Fincorp are also expected to see a significant impact on their Common Equity Tier 1 (CET1) ratios.

CET1 measures a bank's core capital, including its shares and retained earnings, indicating its financial strength and ability to absorb losses. The RBI sets minimum CET1 requirements for banks' stability.

Jinay Gala, Associate Director at India Ratings & Research, stressed the importance of the unsecured space, especially for NBFCs and banks, predicting possible pressure on the current account savings account (CASA) ratios, which could indicate a slowdown in low-cost deposit accounts.

Also Read

Jairam Sridharan, managing director of Piramal Capital & Housing Finance, viewed the RBI's measures positively, acknowledging their necessity for maintaining the health of the financial system, despite a potential short-term impact on growth.

Rajneesh Karnatak, MD and CEO of Bank of India commented on the implications for CRAR (Capital to Risk-Weighted Assets Ratio), estimating a reduction of about 30 basis points and advocating a cautious approach.

CRAR is a ratio that shows how much capital a bank has compared to the risks in its loans and investments.

Somnath Mukherjee, CIO and senior Managing Partner at ASK Private Wealth considered the regulatory measures beneficial for banking system stability but emphasised that banks and large NBFCs would need to adapt their strategies in response.

Watch the accompanying video for a comprehensive discussion of these recent developments.

(Edited by : Shweta Mungre)

First Published: Nov 17, 2023 7:52 PM IST