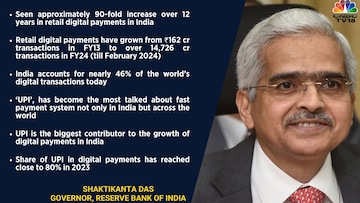

Shantikanta Das, the Governor of the Reserve Bank of India (RBI), on Monday (March 4) said they have seen 90-fold increase in retail digital payments over the last 12 years.

"Retail digital payments have grown from 162 crore transactions in FY13 to over 14,726 crore transactions in FY24 (till February 2024)," he said.

India now holds a dominant position on the global stage, contributing nearly 46% of the world's digital transactions.

The RBI's Digital Payment Index has witnessed a four-fold rise over the last five years.

As per Das, the Unified Payments Interface (UPI) is the most talked-about fast payment system not just within India but worldwide.

"Share of UPI in digital payments has reached close to 80% in 2023," Das said.

Currently, UPI is processing close to 42 crore transactions in a day.

Governor Das highlighted the progressive acceleration in reaching the tipping point for the next 1,000 crore transactions in UPI.

He emphasised the role played by trust, grounded in transparency, ease of use, and, above all, security, in the widespread adoption of digital payments.

In line with the RBI's Payments Vision 2025, Das announced the launch of an interoperable payment system for internet banking transactions later this year.

"The new system will facilitate quicker settlement of funds for merchants," he said.

Meanwhile, UPI transactions reported a slight decrease in both volume and value in February 2024, according to data released by the National Payments Corporation of India (NPCI).

The number of UPI transactions for the month stood at 12.1 billion, compared to 12.2 billion in January, with a transaction value of ₹18.28 lakh crore, down from ₹18.41 lakh crore.

However, the payments made through UPI saw 61% year-on-year growth in volume and 48% year-on-year growth in transaction value, NPCI said.

(Edited by : Shoma Bhattacharjee)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh Lok Sabha elections 2024: Kadapa to Visakhapatnam, a look at key battles

May 8, 2024 5:31 PM

NCP's likely merger with Congress — why Sharad Pawar want to settle the future of his party sooner

May 8, 2024 5:04 PM

Andhra Pradesh Lok Sabha elections: All about Congress candidates

May 8, 2024 2:11 PM