As India's financial landscape undergoes a revolutionary transformation, the integration of the Unified Payments Interface (UPI) with ATMs is playing a pivotal role in bridging the gap between cash and cashless transactions. On the occasion of the one-year anniversary of UPI-enabled ATMs, let's explore how this development is reshaping the financial ecosystem.

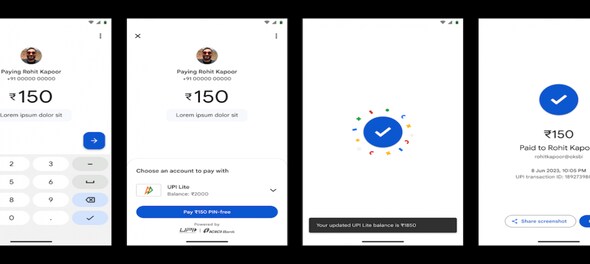

In recent years, UPI has emerged as a transformative force, simplifying digital payments for peer-to-peer transactions, bill payments, and online shopping. With the advent of UPI 2.0, a ground-breaking feature has been introduced – the integration of UPI on ATMs for cash withdrawals.

This marks a significant expansion of UPI's role as a payment system, contributing to India's push for digital financial solutions. Amongst 505 UPI Live members there are 437 Banks playing a role of issuer with another 55 Banks playing a role of Issuer as well as Payment Services Provider (PSP) and 13 Fintech companies as issuer and PSPs.

Cash and cashless transactions

Contrary to the perception of a cashless economy, the inclusion of UPI on ATMs acknowledges the enduring importance of physical currency, especially in a diverse economy like India. This strategic move recognises the necessity for both cash and cashless transactions to coexist, aligning with the country's agenda for financial inclusion.

For the banking sector, UPI-enabled ATMs represent a game-changer. The streamlined process of cash withdrawal reduces reliance on physical debit cards and PINs, simplifying transactions and enhancing security. This not only benefits users but also reduces operational costs for banks, promoting a shift towards digital transactions and modernising the financial infrastructure.

Addressing security concerns

Security holds paramount importance in the realm of digital finance, and UPI ATMs effectively address this concern. Transactions are safeguarded through the use of UPI PINs and two-factor authentication, instilling confidence in users regarding the safety of their financial assets.

The security protocols are redefined by streamlining traditional ATM components. Through mobile-centric interactions, it eliminates the vulnerability associated with card readers, relying instead on QR codes or mobile authentication for transactions. The integration of modern security measures not only builds trust but also accelerates the adoption of UPI-enabled ATMs.

By eliminating failure prone parts such as card readers, encrypting PIN pads, biometric readers for user credentials, UPI ATM has higher availability for customer transactions. Moreover, by digitising transaction records and eliminating paper receipts, it ensures a more secure and paperless banking experience, thereby reducing the risk of sensitive information exposure.

Beyond urban areas

The impact of UPI-enabled ATMs extends beyond urban centres, potentially reaching underserved and remote areas. This expansion of accessibility contributes significantly to bridging the financial inclusion gap. By reducing dependency on brick and mortal branches, UPI-enabled ATMs play a crucial role in making banking services more readily available, even in rural and remote regions using their mobile

As UPI 2.0 continues to evolve, its integration with ATMs is seen as a complementary tool rather than a replacement for physical currency. This trend signifies a shift in perspective, recognizing UPI as a supportive mechanism that facilitates seamless access to cash, emphasising the continued robustness of cash usage in the country.

On this one-year milestone, UPI-enabled ATMs stand as a symbol of progress, convenience, and financial inclusion in India. As technology continues to evolve, these ATMs are poised to further transform the way people access cash, contributing to India's journey toward a digitally driven, financially inclusive society.

Conclusion

As I conclude this article, my view is that while UPI ATMs introduce an innovative approach to banking, they are unlikely to entirely supplant traditional ATMs due to varying user preferences and infrastructural limitations. Traditional ATMs cater to a wide demographic, offering familiarity and accessibility to those who rely on physical cards and conventional PIN inputs.

Moreover, in areas lacking robust internet connectivity or smartphone penetration, traditional ATMs remain a vital financial access point. Additionally, the coexistence of cash-based transactions and diverse banking needs necessitates the continued presence of conventional ATMs, ensuring inclusive financial services for all segments of society. Therefore, while UPI ATMs offer technological advancements, the symbiotic presence of both forms of ATMs remains crucial to accommodate diverse user requirements and technological adaptability.

—The author, Manjunath Rao, is President, Managed Services, CMS Info Systems. The views expressed are personal.

(Edited by : C H Unnikrishnan)

First Published: Dec 30, 2023 12:32 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Supreme Court says it may consider interim bail for Arvind Kejriwal due to ongoing Lok Sabha polls

May 3, 2024 4:57 PM

10% discount on fare on Mumbai Metro lines 2 and 7A on May 20

May 3, 2024 2:40 PM