The yield on the 10-year government bond crossed 7 percent as the Reserve Bank of India (RBI) raised the held-to-maturity (HTM) limit to 23 percent.

The 10-year bond yield had already inched nearly 7 percent before the policy meet. The 10-year benchmark government bond yield rose by 1.37 percent on April 8 during the RBI announcement after 10 am. It was up by around 1.98 percent at 1 pm.

The 10-year bond yield had closed at 6.91 percent on April 7, 6.92 percent on April 6, and nearly 6.90 percent on April 5.

"To enable the banks to better manage their investment portfolio during 2022-23, it has been decided to enhance the present limit under the HTM category from 22 percent to 23 percent of NDTL (net demand and time liabilities) till March 31, 2023," RBI Governor Shaktikanta Das said.

"It has also been decided to allow banks to include eligible SLR (Statutory Liquidity Ratio) securities acquired between April 1, 2022, and March 31, 2023, under this enhanced limit. The HTM limits would be restored from 23 percent to 19.5 percent in a phased manner starting from the quarter ending June 30, 2023," he said.

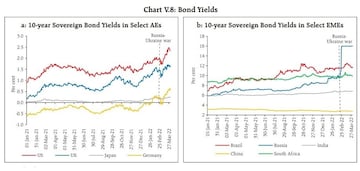

Bond yields have hardened for most emerging market economies (EMEs) from mid-February, with a notable spike in Russia, followed by some softening in the second half of March. Bond yields across major advanced economies (AEs) broadly rose in Q4:2021, as investors grappled with protracted inflation risks and withdrawal of monetary accommodation by major central banks

Source: RBI

Source: RBIThe US 10-year bond yield raced up above 2.0 percent in early February before retreating on safe-haven demand. With the tightening cycle commencing, the 10-year bond yield moved up from mid-March, hitting a 3-year high of 2.5 percent in the last week of the month.

According to an RBI report, the US long-term yields impact other countries through various channels, with consequent portfolio rebalancing and capital outflows putting pressure on emerging market exchange rates and bond prices.

The Russia-Ukraine war and the rising fuel prices prompted the six-member Monetary Policy Committee (MPC) to increase the inflation forecast for the current fiscal year and lower its estimates for real Gross Domestic Product (GDP) growth for FY23 GDP to 7.2 percent from 7.8 percent.

"The RBI projects CPI (Consumer Price Index) inflation at 5.7 percent for FY23, as against 4.5 percent projected earlier," Das said.

The RBI now sees GDP growth at 16.2 percent in Q1 as against 17.2 percent earlier, and at 6.2 percent in Q2 as against 7 percent earlier. For Q3, the central bank now projects GDP expansion at 4.1 percent as against 4.3 percent earlier, and 4 percent for Q4 as against 4.5 percent earlier.

Shaktikanta Das said the RBI assumed the crude rate at $100 per barrel to estimate CPI and growth. He feels crude oil prices would remain elevated for some time.

The bond yields were anchored amid global volatility as they had been given a reprieve from government debt supply for February and March. The government's borrowing programme for FY22 came to an end on February 25, and for that month supply of bonds hitting the market was lower than expected because of cancelled auctions.

The MPC voted unanimously to keep the repo rate unchanged at 4 percent and remain accommodative while focusing on withdrawal of accommodation to ensure that inflation remains within the target going forward while supporting growth.

LIVE RBI monetary policy blog

First Published: Apr 8, 2022 10:48 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!