Given the excitement in Indian audiences for Hollywood films like Barbie, Oppenheimer and Mission: Impossible – Dead Reckoning Part One, among others, this year, it does not come as a surprise that cinema exhibitor PVR INOX and brokerages are optimistic about the rest of the financial year.

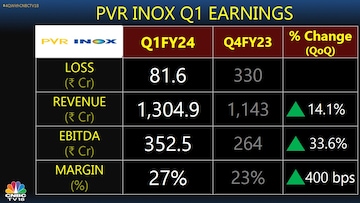

PVR INOX saw a consolidated net loss of Rs 81.6 crore for the April to June quarter, which is much lower than Rs 330 crore in the previous quarter and also over 13 percent less than the CNBC-TV18 poll estimate of Rs 94 crore. The company, earlier known as PVR Ltd, posted a net profit of Rs 53.4 crore in June ended three month period a year ago, according to a regulatory filing.

On other parameters including revenue, earnings before interest, taxes, depreciation, amortisation (EBITDA) and margin, PVR witnessed

sequential improvement and also performed largely better than estimates.

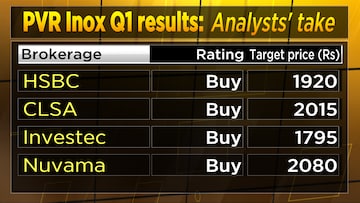

Though HSBC believes that the firm’s first quarter performance was “disappointing”, it says the sequential rebound augurs well for the rest of the 2023-24 financial year. The brokerage pointed out that Hollywood saw an impressive rebound while the Hindi box office appears to have stabilised. It noted the recovery in Hindi cinema and said the merger synergies are key catalysts.

In a post-earnings conversation, PVR MD Ajay Bijli and CFO Nitin Sood said content is coming back, people are wanting to consume movies on the big screen and even the smaller movies have done well in the June quarter.

In India, Oppenheimer has done much better than Barbie, the management said, adding that Independence Day weekend is expected to be big with Gadar 2 and OMG 2.

During the quarter, PVR saw strong growth in the ticket price and is looking for a growth of 6-8 percent in the current fiscal year, they said, adding revenue could be around Rs 7,000 crore.

India box office number for July was at Rs 1,000 crore, they added.

CLSA highlighted that the management is optimistic about the current line-up. It believes volatility in Hindi films has reduced and the firm benefitted from the surge in Hollywood, the brokerage said.

PVR Inox added 27 net screens for a total of 1,707 screens now, results show.

Investec, meanwhile, pointed out that the improvement in sight of Q1FY24 performance of PVR (weaker YoY given the very high base) was better than Q4 across revenue and profitability metrics.

“We expect this improvement to continue in Q2FY24E given the recent trends and strong pipeline ahead. While Q1 performance is significantly below the annual run rate that we are building for PVR in FY24E, we expect a catch-up in performance in the next few quarters and hence maintain our estimates,” it said.

Nuvama also said the market share for Hindi and Hollywood movies rose significantly in the first quarter. “The content pipeline for Q2FY24 and FY24 at large is robust. We continue to reiterate our positive stance on multiplexes over the medium/long term,” it said.

It added that Hollywood and regional films are driving footfall while Hindi films are recovering. Movies such as The Kerala Story, Adipurush, PS 2 and Fast X were the major crowd pullers for Q1FY24, and the company registered 1.75x QoQ growth (from Rs 131 million to Rs 230 million) in the average box office of top 10 films. Market share for Hindi and Hollywood is significantly higher than last year and increased to 39 percent (from 23 percent) for Hindi and 24 percent (from 14 percent) for Hollywood movies, the brokerage noted.

Watch the accompanying video for more