The total value of acquisitions of renewable energy projects in India surged by 300 percent to $6 billion in the first 10 months of this year from $1.5 billion recorded in 2020, reflecting the interest of investors in climate-friendly technologies, according to a study.

The leap in acquisitions was a result of the accommodative monetary policy by the Reserve Bank of India and the conducive global financial conditions, the report by CEEW Centre for Energy Finance (CEEW-CEF) and the International Energy Agency (IEA) said.

The biggest deal in the sector was Adani Green’s takeover of SB Energy India at an enterprise value of $3.5 billion in October.

"A healthy level of merger and acquisition activities signals continued interest to invest in Indian renewables, facilitating the entry of financial investors and allowing developers to exit at attractive returns," CEEW-CEF Programme lead Arjun Dutt said.

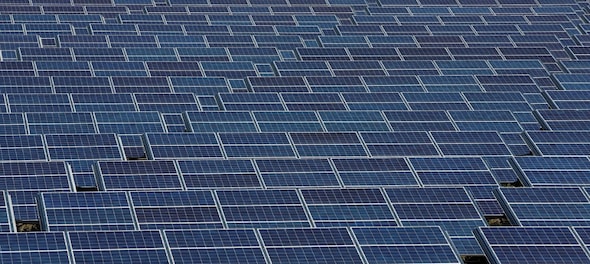

According to the report titled 'Clean Energy Investment Trends 2021', solar photovoltaic capacity awarded till June 2021 nosedived to 2.6 gigawatts (GW) from 15.3 GW reported in the same period in 2020. The sharp decrease came on the back of a backlog of around 20 GW of unsigned power sales agreements with the Solar Energy Corporation of India in 2020, the report said.

Read Also | Big Deal: Renewables witness huge M&A trend, investors show interest in green energy; experts discuss

There has been active interest in India’s green energy space. At least 20 companies, including BlackRock, KKR, Macquarie Group, JSW Group, Adani Group and Canada’s Brookfield Asset Management, are vying for private equity firm Actis LLP’s renewable energy platform Spring Energy, Mint reported.

Canadian pension fund Ontario Municipal Employees’ Retirement System (OMERS) has inked a $219-million deal to acquire a 19.4 percent stake in Azure Power Global from the International Finance Corporation (IFC) and IFC GIF Investment Company.

Thailand’s energy major PTT Group announced its plan to purchase a 41.6 percent stake in Avaada Energy Pvt Ltd for around $454 million.

Going forward, India's renewable energy sector is likely to face headwinds as an increase in prices of PV modules could lower realised returns than those priced into tariffs at the time of bidding, the report said. Modules account for nearly 60 percent of the total cost of a solar power project. Module prices have reached its highest since 2019 at 28 cents per kilowatt-hour (kWh) on the back of a spike in crude oil, gas and coal prices.

(Edited by : Thomas Abraham)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Elections | What does a low voter turnout indicate for NDA and I.N.D.I.A Bloc

Apr 29, 2024 5:48 AM

'Borrowed' leaders: Congress hits out at AAP for not fielding their own candidates in Punjab

Apr 28, 2024 9:53 PM

EC asks AAP to modify election campaign song and Kejriwal's party is miffed

Apr 28, 2024 9:25 PM