The government has decided to cut the windfall tax or the special additional excise duty (SAED) on domestically produced crude oil and diesel exports starting Thursday, February 16.

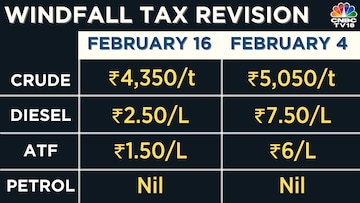

Following the fortnightly review, the windfall tax on crude petroleum produced by firms such as state-owned Oil and Natural Gas Corporation (ONGC) has been reduced to Rs 4,350 from Rs 5,050/tonne as per the previous revision.

The additional duty on diesel has been brought down to Rs 3 from Rs 7.5/litre earlier and the levy on aviation turbine fuel (ATF) or jet fuel has been cut to Rs 1 from Rs 6/litre, according to the latest notification issued by the Ministry of Finance.

The levy on petrol continues to be nil.

The windfall tax or SAED is a one-off tax imposed by a government on a company or industry when it benefits from something that it is not responsible for, the financial gain that ensues is called windfall profits.

Sources earlier told CNBC-TV18 that the government expects to collect Rs 25,000 crore this financial year from windfall gains tax. They added that the government has not prepared any estimates for the collections next year as levies are dynamic and subject to fortnightly changes.

The windfall profit taxes was first imposed on Indian companies on July 1 as the nation joined a growing number of countries that tax super normal profits of energy firms. However, international oil prices have cooled since then, eroding the profit margins of both oil producers and refiners. Export duties of Rs 6 per litre (USD 12 per barrel) were levied on petrol and ATF and Rs 13 a litre (USD 26 a barrel) on diesel at first and have been revised several times.

While windfall profit tax is calculated by taking away any price that producers are getting above a threshold, the levy on fuel exports is based on cracks or margins that refiners earn on overseas shipments. These margins are primarily a difference of international oil price realised and the cost.

The SAED was last revised by the government with effect from February 4, 2023, when the Centre had adjusted its windfall tax on crude petroleum by Rs 3,150 per tonne, and diesel and air turbine fuel (ATF) by Rs 2.5 per litre each, the Finance Ministry notification said.

Separtely, Finance Minister Nirmala Sitharaman on February 15 said that petroleum products can be included in the Goods and Services Tax (GST) framework once an agreement in this regard is reached among states.

"The provision is already available for petroleum products to be brought into the GST. My predecessor had already made the window kept open," she said while speaking at the Post-Budget interactive session with the members of the industry chamber PHDCCI on February 15.

Meanwhile, golablly, oil futures were flat to lower on February 15 as the US dollar strengthened and investors worried that rising interest rates would slow the economy and cut fuel demand. Oil's losses were limited as the market discounted a big build in US crude stocks due to a data adjustment and as the International Energy Agency (IEA) forecast higher global oil demand growth.

First Published: Feb 16, 2023 8:03 AM IST