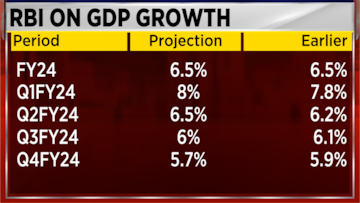

The Reserve Bank of India (RBI) on Thursday retained its GDP growth projection for the current financial year at 6.5 percent, citing factors such as higher Rabi crop output, moderating commodity prices, favorable monsoon projections, and the government's emphasis on increased capital expenditure.

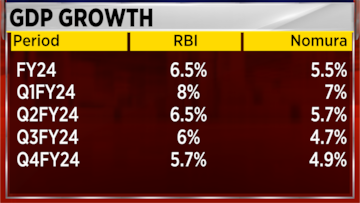

However, economists hold divergent views on India's growth trajectory. Sonal Varma, MD & Chief Economist-India and Asia ex-Japan at Nomura Financial Advisory & Securities, expresses concerns over global headwinds and India's elevated interest rates, which have led to a deceleration in growth. Varma predicts a GDP growth of 5.5 percent in FY24.

On the other hand, Upasana Chachra, Chief India Economist at Morgan Stanley, aligns with the RBI's optimistic outlook, considering India's 6.5 percent growth rate to be among the fastest in the world.

In an interview with CNBC-TV18, Varma said that the

Reserve Bank of India has not excessively tightened its monetary policy but has rather adopted a more normalised approach. However, she highlights a 250-basis point increase in interest rates over the past year, noting that it takes approximately 12 months for these rate hikes to impact economic growth and subsequently inflation.

Varma explains, "The last 12 months reflect the monetary conditions from a year ago, and the impact of last year's monetary policy normalization coincides with global spillovers. It is this combination that leads us to anticipate a cyclical moderation, bringing growth to around 5.5 percent."

Meanwhile, Chachra said that Morgan Stanley has a constructive view of the

Indian economy. She said, “The primary story for India does remain, the strength in domestic demand will continue. So, growth will sustain closer to the numbers that we saw in the March quarter, and for FY24 we expect growth at 6.2 percent; our number on the calendar year is at 6.5 percent, but in FY25 we do think growth remains above 6 percent.”

However, a day after RBI said India could grow 6.5 percent, the Chief Economic Advisor V Anantha Nageswaran said, “I feel FY24 growth will be close to 6.5-7 percent due to higher investments and digital transformation. We have barely scratched the surface of the digital transformation in India.”

“We need to prepare for the climate change impact; maintain economic growth and make sure we also grow sustainably,” the CEA added.

For more details, watch the accompanying video