“It would be a very welcoming, positive surprise if the Fed were to come in and say they are going to pause for now. But, looking at the consumer price index (CPI) print numbers, we should brace for another rate hike,” Dean Kim, Head-Global Research Product at William O'Neil + Co., said in an interview with CNBC-TV18.

The next US Federal Reserve monetary policy meeting is scheduled from October 31 to November 1.

Key takeaways from US CPI Data

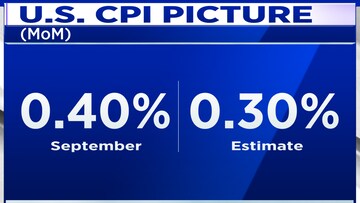

US consumer prices in September rose slightly faster than expected due to higher gas prices and rental costs. This has raised the possibility of the Federal Reserve initiating another round of interest rate increases.

CPI for September rose 3.7%, per data released by the Bureau of Labor Statistics (BLS) on October 12.

However, core inflation, which excludes the volatile components of energy and food prices, remained stable with a 0.3% month-on-month (MoM) increase, aligning with analysts' forecasts. On a year-on-year (YoY) basis, core inflation saw a slight decline from 4.3% to 4.1%.

The September

jobs report released last week delivered a surprise, revealing the addition of 336,000 jobs, nearly double the anticipated figure. The unemployment rate held steady at 3.8%. The robust performance had already prompted traders to adjust their expectations, with increased bets on an interest rate hike by the year's end.

Kim said it would come as a shock if the

US Federal Reserve were to unexpectedly declare a halt in their ongoing series of interest rate increases. Such a move has the potential to create a profound ripple effect in the worldwide financial markets, especially considering that numerous individuals were anticipating further rate hikes to address inflation concerns.

US treasury yields also jumped as investors assessed recent economic data indicating persistent and elevated inflation. The yield on the 10-year Treasury bonds saw an uptick of approximately 11 basis points, reaching 4.707%, rebounding from its earlier session lows.

“The

US Treasury bond auction that went on this week, the demand was weaker than expected prompting the yields to elevate,” Kim added.

Contributing to the anxiety is the anticipation of the upcoming earnings reports from major financial institutions such as JPMorgan Chase, Citigroup, and Wells Fargo.

The US markets slipped on Thursday, following a two-day surge and in response to the latest inflation data.

The Dow Jones, S&P 500, and Nasdaq lost half a percent each. Dow Futures were down marginally at 33,775 early Friday.

(with input from agencies)

For more details, watch the accompanying video

(Edited by : Shweta Mungre)

First Published: Oct 13, 2023 2:38 PM IST