The Maharashtra government on December 21 announced a loan waiver of up to Rs 2 lakh for farmers with a cut off date of September 30, 2019, and providing relief to non-defaulting farmers who have a loan above Rs 2 lakh.

The cost of this farm loan waiver would be at least Rs 45,000 crore, according to analysts. Maharashtra has a large share of agriculture credit in the country and it also has the largest contribution to agriculture Non-Performing Assets (NPAs) in the country as per RBI data.

Around 15 percent of overall agriculture NPLs in the country are contributed by Maharashtra.

Analysts believe farm loan waiver is the moral hazard and it undermines credit discipline among farm loan borrowers.

“In anticipation of farm loan waivers, certainly capable borrowers with the ability to repay their dues withhold their installments, thus eroding credit culture,” global brokerage Macquarie said in a note.

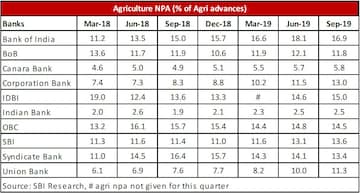

The public sector banks are more severely impacted by such schemes as compared to private lenders as they have around 50 percent share in farm credit. The loan waiver has a negative impact on asset quality & growth.

"Frequent occurrence of actions like loan waivers lead to the risk of impaired credit discipline. Public banks face greater impact than private banks in the case of loan waivers," said Kotak Institutional Equities.

This is the second consecutive a farm loan waiver announced by Maharashtra government in the last two and a half years. The previous loan waiver was announced by the Devendra Fadnavis government in June 2017.

"The previous waiver has had a negative impact on asset quality and growth in the agricultural loan portfolio in the state. As per a recent RBI report, Maharashtra has seen a sharp rise in agriculture loan NPLs in FY18 from less than 10 percent in FY17 to around 17 percent in FY18, indicating a likely deterioration in credit discipline as a result of the loan waiver announced in Q1FY18," Kotak said.

The immediate impact is that NPLs get written off from banks’ balance sheets and banks get cash, optically NPLs come down and liquidity improves. However, over the long term, NPLs shoot up due to deterioration in credit culture.

Even private sector banks have sustainably seen a steady increase in their agriculture NPLs over the past several years, Macquarie added.

According to SBI Research, this time the cost of a loan waiver in Maharashtra could be at least Rs 45,000 crore. The cost could go up to Rs 51,000 crore if the number of farmers covered increases from the current levels. The cost could come down by Rs 12,500 crore if the new dispensation decides to postpone the payments outstanding under the earlier loan waiver scheme into the new one or decides to limit the coverage of farmers under the scheme.

In 2017-18, 44 lakh farmers got maximum benefit out of 89 lakh farmers who availed crop loans and eligible for loan waiver.

SBI Research estimates this time 50 lakh or more farmers might get the maximum benefit due to an increase in ceiling limit from Rs 1.5 lakh to Rs 2 lakh.

Further, the research house finds that the amount of loan waiver announced in a particular year is disbursed over the course of a few years and the amount disbursed is invariably less than what was previously announced.

Agriculture NPA is Rs 1.1 lakh crores or 12.4 percent of overall NPA, and also accounting Rs 3.14 lakh crores loan waiver announced in the last decade. Hence, the total agriculture NPA burden for the exchequer or banks could be as much as staggering Rs 4.2 lakh crore and if this latest Maharashtra scheme is added, it will be at Rs 4.7 lakh crore, which is 82 percent of industry NPA.

Farm loan waivers thus ostensibly act as a mechanism in increasing farmer indebtedness, rather than reducing it. Farm loan waivers are only a band-aid solution to the structural malaise in the rural sector and typically undermine an honest credit culture and adversely impact credit discipline, the research house added.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna's father in custody for alleged kidnapping and sexual abuse

May 4, 2024 7:53 PM

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM