On Tuesday, the government announced capital infusion of Rs 11,337 crore in Punjab National Bank, Indian Overseas Bank, Andhra Bank, Corporation Bank and Allahabad Bank.

Of the Rs 11,337 crore, Rs 2,816 crore will be infused in PNB, Rs 2,555 in Corporation Bank, Rs 2,157 crore in IOB, Rs 2,019 crore in Andhra Bank and Rs 1,790 crore in Allahabad Bank.

Out of these five banks, Corporation Bank, Allahabad Bank and IOB are under the prompt correction action of RBI.

What does this mean for the banks?

The government's action is expected to improve the tier 1 capital ratio of these banks.

Tier 1 capital is the core measure of a bank's financial strength which is composed of core capital, consisting common stock and disclosed reserves.

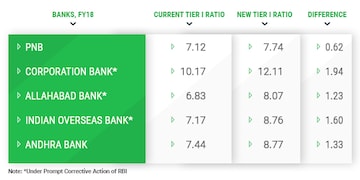

Corporation Bank is said to be the biggest beneficiary of the move as its tier 1 capital ratio will climb to 12.11 percent from the current 10.17 percent, followed by Indian Overseas Bank which will see a rise in its tier 1 capital ratio by 1.60 percent to 8.76 percent against the current 7.17 percent.

Andhra Bank’s ratio will stand at 8.77 percent against the current 7.44 percent, while Allahabad Bank and PNB’s tier 1 capital ratio will improve to 8.07 percent and 7.74 percent from 6.83 percent and 7.12 percent respectively.

First Published: Jul 18, 2018 11:47 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Rapido offers free rides to voters to polling stations on May 13 in Hyderabad, 3 other cities

May 6, 2024 5:49 PM

Lok Sabha elections 2024: Seats to date, all you need to know about third phase of voting

May 6, 2024 4:49 PM

Concerns on low voter turnout a "myth"; absolute number of voters correct way to analyse: Report

May 6, 2024 2:57 PM

Haryana Lok Sabha elections 2024: A look at JJP candidates

May 6, 2024 2:26 PM