The global economy has been in a state of flux lately, with various factors impacting growth and stability. Many emerging markets rely heavily on foreign capital inflows, which could decrease if the US Federal Reserve decides to delay rate cuts. This could lead to increased volatility in these markets and make it more difficult for them to attract the foreign investment they need to grow.

In an interview with CNBC-TV18, Rob Subbaraman, who is the head of global macro research at Nomura, spoke about how emerging markets (EMs) could feel the pressure from a delay in rate cuts by the US Federal Reserve.

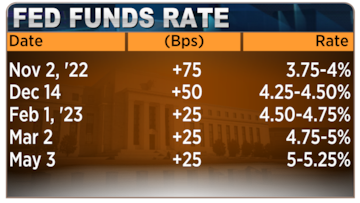

He said, "We are going to see more credit tightening in the US. The debt ceiling crisis that is building could get worse and when that happens, markets are going to be demanding for the Fed to start cutting. With inflation so high, I don't think the Fed is ready to cut and it could be a bit of a negative situation for emerging markets when growth slows, but inflation is still high, and the Fed is not ready to cut but the market wants cuts."

Subbaraman also commented on the recent dovish statement made by US Fed Chair Jerome Powell. He suggested that Powell's statement could indicate a shift towards a more accommodative monetary policy, which could help to support global growth in the short term. However, he cautioned that this could lead to higher inflation in the long term, which would be detrimental to both emerging and developed markets.

Turning his attention to China, Subbaraman predicted that China's growth would slow down, which could impact India's export sector. China is one of India's largest trading partners, and any slowdown in the Chinese economy could have significant implications for India's exports. Subbaraman suggested that India needs to focus on diversifying its export markets to reduce its reliance on China.

Robert Sockin, who is a Global Economist at Citi, spoke about the pressure on the Fed to hike rates more. He noted that the US economy has been performing well, with low unemployment and solid GDP growth. This could lead to increased pressure on the Fed to raise interest rates to prevent the economy from overheating.

However, Sockin also pointed out that there are risks tilted toward pausing versus hiking more. He suggested that the Fed needs to strike a delicate balance between supporting economic growth and preventing inflation from spiraling out of control.

For the entire discussion, watch the accompanying video