The Federal Reserve is expected to evaluate options to fight the red-hot inflation in the United States when it meets at its monetary policy meeting on March 22. Until recently the US central bank was widely predicted to raise fed fund rates by 25 basis points at least from the current 4.50-4.75 percent this month, but economists are now divided on that view and some are even expecting the Fed to hit the brakes and stay on the sidelines.

The Fed started rising interest rates in March 2022 – just a year back in this cycle after the US recovered from the pandemic-led economic slowdown and Chairman Jerome Powell last month said that FOMC may have to keep raising rates for longer than previously expected as inflation remains stubborn.

While the pace of hikes has slowed over the months, there is a rising disagreement amongst economists about the Fed’s next move.

Uncertainty about the Fed’s next move comes at a time when the ECB has hiked rates by 50 basis points last week despite a rout in global markets triggered by worries about the future of Switzerland's Credit Suisse bank.

Goldman Sachs: Outs March Hike Call

Goldman Sachs, one of the biggest investment banks in the world and a US primary dealer - who buys and sells Government securities directly from the Government, now expects the Fed to stay put at its policy meeting on March 22.

“In light of the stress in the banking system, we no longer expect the FOMC to deliver a rate hike at its next meeting on March 22,” Goldman Sachs economist Jan Hatzius said in a research note.

Goldman now expects the Fed to deliver only a 25 basis point rate hike in May, June & July and the terminal rate at 5.25-5.5 percent, while they see considerable uncertainty about the path.

The change in views came as the US banking system faces severe threats with several banks nearing a collapse. It started with Silicon Valley Bank’s shares crashing after it sold $21 billion worth of bond assets at a loss of $1.8 billion on March 8. Silicon Valley Bank is the first FDIC-insured bank to fail in more than two years, the last was Almena State Bank in October 2020.

This scenario takes us back to Sep 15, 2008, the collapse of the investment banking giant Lehman Brothers, which also found itself on the verge of bankruptcy triggering the worst of the Global Financial Crisis.

First Citizens BancShares Inc is now evaluating an offer for Silicon Valley Bank, Bloomberg News reported on Saturday, citing people familiar with the matter.

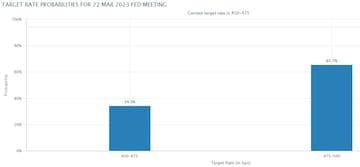

Many now think that the Fed may pause as interest rate hikes impact the banking system the most. That is despite inflation running historically high. The money market is still pricing in a 25 bps hike at the March meeting.

Source: CME FedWatch Tool

Source: CME FedWatch ToolCiti: Still With 50 Basis Points Hike

However, Citi, another US primary dealer has a different take.

Robert Sockin, Global Economist at Citi said banking stability will be a marginal factor in the Fed’s thinking, Fed may raise rates by 50 basis points this month and won’t be surprised if the Fed has to hike interest rates up to 6 percent.

That is largely in line with the CME Fed Tool which shows the probability of a 50 basis point hike is higher than a 25 basis point increase.

“Think, SVB was idiosyncratic; broader banking sector in the US is healthy and large banks have high capital ratios,” Sockin Added.

Citi re-affirmed its 50 basis point Fed rate hike call.

Nomura now expects a 25 bps rate cut and a halt to Fed’s balance sheet reduction on March 22.

But Former RBI Governor Raghuram Rajan in an exclusive interview with CNBC-TV18 said that a pause in the next Fed meeting looks like a low probability and a 25 bps hike still looks like a strong possibility, 50 bps is off the table.

"Well, I think in the US, at least for the moment there seems to be a sense that the Fed has pulled out all stocks. Depositors have been guaranteed right up to the largest depositors who typically are uninsured and second, banks have access to liquidity by using the entire value of their bond portfolio. Remember, there are two reasons for concern in the US. One is a lot of small and medium banks are sitting on unrealized losses on their bond portfolios," Rajan said.

(Edited by : Abhishek Jha)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!