The Federal Open Market Committee or the FOMC released its July minutes, and the bulk of the statements appear to be hawkish. The members said they won't pull back until inflation comes down substantially.

"With inflation remaining well above the Committee's objective, participants judged that moving to a restrictive stance of policy was required to meet the Committee's legislative mandate to promote maximum employment and price stability," reads the meeting's minutes.

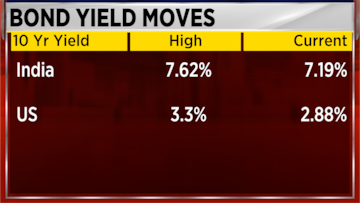

In an interview with CNBC-TV18, Sameer Goel, Global Head-EM Research at Deutsche Bank and A Prasanna, Chief Economist at ICICI Sec-PD discussed the impact of the US Fed's minutes on the next RBI rate move and where the bond market, which has been having a party off late as yields have fallen substantially on a mix of lower crude prices and softer inflation readings, might be headed.

Goel said that currently the central banks are approaching inflation targets from above and not below.

“This is an environment in which central banks are faced with a situation where you are approaching inflation targets from the above rather than from below and therefore calibrating how much tightening needs to be further done, becomes very critical,” he said.

Will the RBI follow with a hawkish tone? Goel doesn't feel so.

"To our mind, it's kind of overdone to the extent the markets now expect RBI to become a lot more dovish,” said Goel.

Meanwhile, Prasanna said that ICICI Sec-PD does not see any reason for a bond market rally based on current fundamentals.

“When I look at both fundamentals and valuation, I do not understand this rally. I think a lot of it is just momentum; people are trying to copy what is happening in the US markets, people are looking at US curve inverting and of course, that has implications for our swap markets and then maybe the bonds are also rallying in sympathy, but I do not see this sustaining if I look at valuation and fundamentals,” he said.

For the entire discussion, watch the accompanying video

(Edited by : Abhishek Jha)

First Published: Aug 18, 2022 3:37 PM IST