Market expert Mark Matthews, Managing Director at Bank Julius Baer & Co, doesn’t think of the US debt ceiling as an issue and says he agrees entirely that US President Joe Biden is very good at negotiating.

“So, he decided to do it after he said he would not do it with the Republicans. And so, we will have a deal and we always would have had to deal, we know that. And the worst-case scenario is he would have invoked this archaic amendment 14th, which says, the US shall never default on its debt. So, I don't think the debt ceiling is an issue,” he said in an exclusive interview with CNBC-TV18 on May 18.

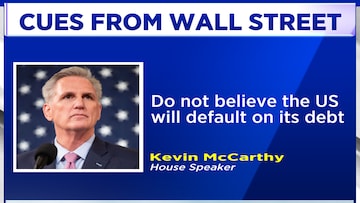

Matthews’ remark comes as investor sentiment got a boost after leaders in Washington indicated that they are moving forward on the debt ceiling talks.

Throughout its history, even in challenging times, the US has managed to uphold its financial commitments, instilling confidence among investors and maintaining stability in global markets. This long standing reliability has positioned the US as a safe haven for investments worldwide.

What is the US debt ceiling?

It is the maximum amount of money Congress allows the federal government to borrow to cover its bills. This is because the government generally spends more money than it collects in taxes, so it must take out debt to pay its expenses. Unlike a credit card, though, the expenses were already approved by Congress, so the debt ceiling does not pertain to new spending.

In order to simplify borrowing, this mechanism was created during World War I. Prior to 1917, Congress needed to approve additional debt for each new spending measure it passed.

Congress has lifted the debt limit 78 times since 1960. The debt ceiling was last raised in December 2021 by $2.5 trillion, capping the limit at $31.381 trillion.

Matthews also spoke about the weaknesses in several US banks, citing six major banks in the country grappling with internal issues. Though he didn’t specify exact reasons behind vulnerabilities, his statement underscores the importance of maintaining a robust and transparent banking sector, as any weaknesses can have ripple effects on both domestic and international markets.

He also reflected on the historical trend of a rising US dollar acting as a headwind for Asian markets. Traditionally, when the value of the US dollar appreciates, it exerts downward pressure on Asian currencies, affecting exports, trade balances, and overall investor sentiment. Asian economies, which heavily rely on exports, can face challenges in maintaining competitiveness and achieving desired growth rates in such scenarios.

The United States' commitment to honouring its debt obligations offers a sense of security to investors, fostering stability and confidence in the global financial system. However, the weaknesses observed in a few banks serve as a reminder of the significance of vigilance and robust regulatory frameworks to ensure the health of the banking sector.

(With agency inputs)

For more details, watch the accompanying video

First Published: May 18, 2023 2:53 PM IST