On September 20, Finance Minister Nirmala Sitharaman announced that the government proposed to cut corporate tax rates to 22 percent for domestic companies provided they do not avail exemptions or incentives and 15 percent for new domestic manufacturing enterprises as part of a raft of measures to boost economic growth.

Now, according to research and analytical firm, CRISIL, two in three companies may shift to this new corporate tax regime immediately. A report released by CRISIL goes on to say that half of those shifting may use tax savings for ongoing capex or to strengthen the balance sheet.

ALSO READ:

The findings are based on responses received in a survey of 850 large (by revenue) CRISIL rated companies. It encompasses both listed and unlisted companies spread across all sectors and is, therefore, a close representative of corporate India.

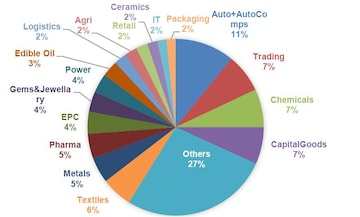

Sector-wise spread of CRISIL-rated large cos surveyed

A third of the companies surveyed – from capex-heavy sectors such as power, and oil & gas – have expressed a desire to continue with the current tax regime. However, a majority of them from sectors such as auto, chemicals, textiles, gems and jewellery, and retail are likely to shift immediately.

ALSO READ: Why the impact of corporate tax rate cuts may be smaller than what the stock market believed

As per the changes to the Income Tax Act, 1961, announced, domestic companies have the option to pay corporate tax at a reduced effective rate of 25.17 percent. This is conditional upon them relinquishing other exemptions such as a set-off of Minimum Alternate Tax credits, and incentives under special economic and tax-free zones. And once exercised, the option is irreversible.

Subodh Rai, Senior Director, and Head, Analytics, CRISIL Ratings says, “Companies shifting to the new regime are likely to see close to 700 bps of tax savings. While this may not kick-start the much-delayed private investment cycle, it could help ease funding constraints of companies to some extent. About half of the companies surveyed said they will use the savings for ongoing capex, reduce debt or retain cash, which would strengthen balance sheets and prime them for fresh capex once demand improves.”

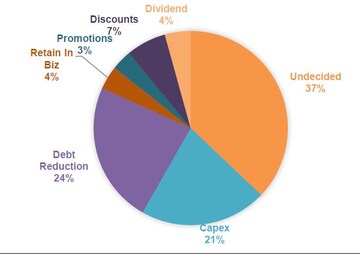

Around 37 percent of the companies surveyed are yet to decide on utilisation of tax savings though the option to increase dividends found the least preference. And just 10 percent said they will pass on the benefit through higher discounts and sales promotion – indicating the tax cut alone may not seed demand growth.

Results of CRISIL survey on utilisation of tax savings

First Published: Oct 15, 2019 4:53 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

PM Modi confident of BJP sweeping Bihar and UP, banks on 'sympathy' in Maharashtra

Apr 29, 2024 9:38 PM

Exclusive: Can't fix elections in India, not even for a municipality, says PM Modi on Opposition charges

Apr 29, 2024 9:25 PM

Supreme Court dismisses plea seeking postponement of CA exams; details here

Apr 29, 2024 2:29 PM

Just 8% women candidates contested first two phases of Lok Sabha polls

Apr 29, 2024 12:00 PM