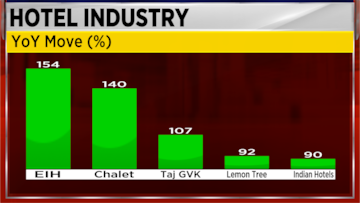

Hotel stocks have been thriving post-pandemic and the rally in the space has further intensified after robust demand boosted occupancies across the segments. Almost all companies in the sector reported healthy operating margins in the third quarter of FY24, aided by strong demand.

The improvement in financial metrics is quite visible in the stock performance of hotels as well. A custom index of 12

hotel stocks has added as much as ₹1 lakh crore to its market capitalisation since the beginning of 2022. While the market valuation of Indian Hotels Co (IHCL) surged the most, with an increase of

₹54,212 crore over the last two years, others like EIH and Chalet Hotels saw their market valuation surge by

₹16,453 crore and

₹12,794 crore, respectively during the same period.

In an interview with CNBC-TV18, Rajesh Magow, Co-Founder and Group CEO at MakeMyTrip and K Srikumar, Senior Vice President & Co-Group Head-Corporate Ratings at ICRA discussed at length how tourism shape will up in FY25.

Magow said, “All segments of travel have come back, and not necessarily only leisure but the business segment, visiting friends and relatives (VFR), the pilgrimage tour and so on. And that is what, I guess, driving the stocks for the hotel industry as well.”

Also Read

Srikumar said that ICRA expects the hotel sector to grow at 14-16% in the current fiscal, FY24 and to the higher single-digit 7-9% in FY25; this is coming on a very high base.

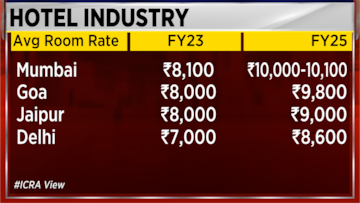

“Occupancy levels are still at a decadal high of 70-72% which will be continuing in FY25 as well. The pan India premium hotel ARR (average room rate); the peak was seen in FY08 above ₹8,000 odd levels that will be hit in FY25 for the industry as a whole, although some of the portals have already crossed all-time high levels in FY24,” he added.

According to ICRA, hotels are experiencing steady growth because it will take some time for the number of hotels available to catch up with the demand. In the airline industry, domestic travel is predicted to return to pre-COVID levels only by fiscal year 2025, although international travel has already reached that point by fiscal year 2023. Tour operators are benefiting from the growth seen in hotels and airlines. However, they still face challenges such as visa issues. Overall, the tourism sector is expected to maintain its momentum and grow more significantly in fiscal year 2025.

In addition to the increasing wealth, there is also a newfound surge in religious or spiritual tourism, fueled by the construction of the Ayodhya temple. However, the tourism sector faces challenges, including the hike in tax collection at source from 5% to 20%, the low influx of foreign tourists into India, visa issues for Indians travelling to the United States, and geopolitical tensions such as those in Ukraine, Palestine, and the Maldives.

In January 2024, hotels in India witnessed a healthy year-on-year (YoY) average room rate (ARR) growth of 11%, with occupancy increasing by 210 basis points compared to the previous year, resulting in a stronger YoY growth in revenue per available room (RevPAR) at 15%. Overall, for the first ten months of the fiscal year 2023-2024, ARR/RevPAR growth stood at approximately 15% YoY.

CRISIL Ratings forecasts that the Indian hotel industry is on track to achieve robust revenue growth of 11-13% in the fiscal year 2025, following a solid performance of 15-17% growth in the current fiscal year. This positive outlook is supported by consistent domestic demand and an increase in foreign traveller interest.

Also Watch: Prashant Pitti, one of the founders of EaseMyTrip, discussed with CNBC-TV18 the collaboration with Jeewani Group to develop a Radisson Blu Hotel with 150 rooms in Ayodhya. The company's investment in this project is estimated to be around

₹100 crore.

For the entire discussion, watch the accompanying video

(Edited by : Shweta Mungre)