Thanks to the collapse of Silicon Valley Bank (SVB) and the jittery state of other banks like Signature Bank, economists are beginning to pencil in fewer hikes from the US Fed, but the Street is deeply divided.

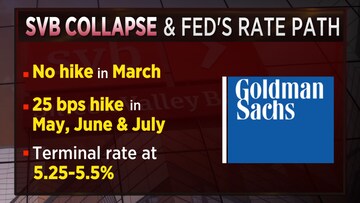

Goldman Sachs is expecting no hike at all at the March meeting, but it sees one hike each in May, June and July taking the terminal rate to 5.25-5.5, but it adds there is considerable uncertainty about the path.

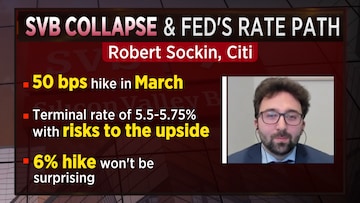

Citi is at the other extreme.

Speaking to CNBC-TV18,

Global Economist Robert Sockin said they expect a 50 bps hike on March 22, and a terminal rate of 5.5-5.75 percent. With risks to the upside, even 6 percent is possible. Sockin thinks SVB is idiosyncratic and that the US banking system is healthy and big banks have high capital.

Also, payroll data showed the labour market is strong and Fed wants to see it slow down. Labour market and inflation will dominate Fed's thinking; banking stability will be a marginal concern he said.

Nomura analyst Sonal Varma continues to expect strong CPI data this week and hence a 50-bps hike from FOMC. So, Nomura maintains their 50-bps hike call but adds that uncertainties have increased.

Morgan Stanley's Ellen Zentner and others writing on Friday said they are going with a 25-bps hike unless this week's core CPI comes in higher than their estimate of 0.38 percent.

Meanwhile,

Rupal Bhansali, CIO-International and Global Equities at Ariel Investments, in an interview with CNBC-TV18, said that the Fed is more concerned with inflation and the economy rather than a single bank. She said, “Inflation and the economy are more their concerns. This bailout is rather limited in scope and has been dealt with rather quickly. So, I am hopeful that the Fed keeps eyes on their mission, which is bringing inflation down.”

According to

Mahesh Patil, CIO at Aditya Birla Sun Life AMC, the US Fed is likely to go slow in terms of rate hikes. “With these kinds of issues coming up, the Fed is now likely to go a bit slow in terms of rate hikes, and that will give some relief to the market over here,” Patil told CNBC-TV18.

Gregory Daco, Chief Economist-Strategy & Transactions, Ernst & Young LLP said, “We are still in an environment where the Fed wants to continue tightening monetary policy; will likely adopt the dual track approach to tightening monetary policy. On the one hand, continuing to raise rates and on the other maintaining its lending program to help stave off some of the stress in the banking sector.”

“The discussion next week is likely to factor in what has happened on the banking sector front, and therefore will likely be between either holding at the constant rate or increasing by 25 basis points. Had there not been banking stress, 50 basis points would most likely have been on the table,” Daco added.

Mark Matthews of Bank Julius Baer & Co said, “We are looking for 25 bps. We had expected another 25 in May. Now we are just saying one in March and that's it. And that is basically because we think that, to Gregory Daco’s point, the credit activity, the economy is decelerating, there is a lag impact of higher rates and the Fed would be, we feel, adopting a more mindful approach considering what has happened with Silicon Valley Bank, etc."

And finally, what does the broad market expect: as per the CME FedWatch Tool, currently, 93.7 percent expect a 25-bps hike, up from 59 percent on Friday; and 0 percent expect 50 bps, down from 40.2 percent on Friday. A minor 6.3 percent expect no hike at all.

First Published: Mar 13, 2023 3:16 PM IST