Official numbers from the Reserve Bank of India show that loan growth for banks has surged to a 10-year high of 17.9 percent. Separately, the excess liquidity in the interbank market has also fallen to a two-year low. This augurs well for the Indian economy's growth prospects and in an interview with CNBC-TV18,

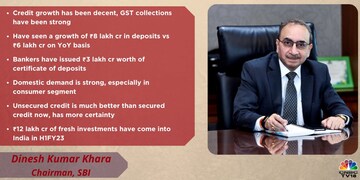

State Bank of India chairman, Dinesh Khara said that he believes the Indian government will be spending more in the second half of the financial year (H2FY23) because of this.

Credit growth is a reflection of the economy doing well and SBI has seen an uptick in deposits to Rs 8 lakh crore in this fiscal from the Rs 6-odd crore in the previous one. Other banks, which have reported their earnings have also shown a similar rise.

“I believe that there is some amount of unspent money from the government, and the kind of buoyancy which was seen in the GST collections gives us some kind of confidence that may be in the remaining part of the current year, we will get to see some money being spent by the government, which will also bring in more liquidity in the system,” said Khara.

The primary driving force for the higher loan growth seen by banks is the strong domestic demand and the SBI chairman is especially bullish thus on the consumer segment.

"Last two years, because of COVID, the demand from the consumer was not as strong. So, domestic demand is huge and moreover consumer segment; the auto sales have rebounded, real estate sales are on the rise despite the fact that home loans are on the upside, contact intensive hospitality services are experiencing a bounce back,” said Khara.

The banker also reckons that the Indian economy should benefit from credit being available at cheaper rates.

“In terms of unsecured credit, though on the face of it it looks like to be unsecured credit, but the fact remains that there is much more certainty. If at all I can go by my own experience, I would say that the unsecured credit is much better than the secured credit,” he said.

For the full interview, watch the video

First Published: Oct 27, 2022 12:43 PM IST